Build a Wholesale Business-Aligned IT Strategy

As technology continues to shape the Wholesale Industry, those organizations that embrace it methodically and strategically, yet innovatively, will be best positioned to succeed.

Speak With A Representative

Request Content Access

Our systems detected an issue with your IP. If you think this is an error please submit your concerns via our contact form.

Wholesalers are facing digital disruption, but IT strategies are often ineffective.

The Wholesale Industry is highly competitive, despite having higher barriers of entry than retail, as it relies on trusted, and contractually obligated, long-term relationships. However, the inventory-light approach of new-age ecommerce platforms is causing significant disruption to the industry.

Despite this, many businesses, including wholesalers, face challenges in developing an effective IT strategy.

CIOs who fail to align their IT strategy with the business objectives encounter misalignment and prioritization issues.

Our Advice

Critical Insight

Approximately 75% of CEOs value tech leaders who bring strategic perspective and operational experience, however….

- Across industries, most of the CIOs are seen as order takers by business CXOs, resulting in the demands on IT far outstripping the IT budget.

- Initiatives and projects are not aligned with business objectives and are either delivered late or put on hold because of mismatched expectations.

Moreover, gaps in client-facing technology can be a source of shadow IT because IT is not seen as sufficiently knowledgeable or engaged with business.

Impact and Result

This wholesale industry-aligned IT strategy blueprint helps you:

- Use Info-Tech’s industry-focused approach to discern the business context.

- Clearly communicate to business executives the value IT adds to the organization’s key objectives and initiatives using the Strategy Presentation Template.

- Make project decisions holistically by using Info-Tech’s Prioritization Tool to identify the most-valuable initiatives to become part of the IT strategic roadmap.

Build a Wholesale Business-Aligned IT Strategy Research & Tools

1. Build a Wholesale Business-Aligned IT Strategy Deck – A step-by-step document that walks you through how to properly align with the business, achieve IT excellence, and drive technology innovation.

As technology continues to shape the wholesale industry, those organizations that embrace it methodically and strategically yet innovatively will be best positioned to succeed. This is where the Build a Wholesale Business-Aligned IT Strategy comes in. An adaptation of Info-Tech’s Build a Business-Aligned IT Strategy blueprint, it keeps the business vision, mission, and priorities at the center while guiding a CIO team at a Wholesale entity in formulating an IT strategy that aligns with their industry context and specific business goals.

2. Strategy-on-a-Page Template for Wholesale

This template uses sample data from "Acme Corp." to demonstrate an ideal IT strategy-on-a-page for a Wholesale business. Use this template to document your final strategy outputs including executive-facing business alignment and strategy highlights, key initiatives and summaries, a strategic roadmap, what success looks like, and IT goals.

3. Business Context Interview Guide – An interview guide to help you elicit the business context by interviewing business leaders and peers.

Use this template as a starting point to interview your business leaders to elicit the business context. The goal of the interviews is to extract business goals, organizational priorities, and business initiatives that will play a critical role in building your IT strategy. Meet with your executive team and work with them to identify essential knowledge.

4. Business Context Discovery Tool – This tool will provide you with business context questions tailored to your initiative. Based on what you need to know but don't yet know, the tool will recommend specific business context discovery activities.

Use this tool to discover what IT needs to know from the business to successfully complete strategic IT initiatives (e.g. IT strategy, IT budget).

5. IT Strategy Presentation Template – A best-of-breed template to help you build a clear, concise, and compelling strategy document for stakeholders.

This presentation template uses sample data from "Acme Corp" to demonstrate an ideal IT strategy. Use this template to document your final strategy outputs including executive-facing business alignment and strategy highlights, key initiatives and summaries, strategic roadmap, budget proposal, IT goals and operating model, functional project roadmaps, and year-in-review data to highlight IT success stories.

6. IT Strategy Workbook – A structured tool to help you prioritize IT strategy activities and build a roadmap to ensure success.

This tool guides an IT department in planning and prioritization activities to build an effective IT strategy. This Excel workbook guides you through making key decisions regarding the visuals that should be incorporated into your final presentation document. Key activities include building a goals cascade visual that shows the relationships between business and IT goals, initiatives, and capabilities; prioritizing key initiatives using a balanced scorecard approach; and building the IT strategy roadmap using a Gantt chart visual to showcase project execution timelines.

Speak With A Representative

Request Content Access

Our systems detected an issue with your IP. If you think this is an error please submit your concerns via our contact form.

Build a Wholesale Business-Aligned IT Strategy

Success depends on clearly aligning IT initiatives to business goals and IT excellence, and driving technology innovation in Wholesale industry.

Analyst Perspective

To dodge the bullwhip, think ahead of your retailers by leveraging technology that has been tailored to wholesalers and distributors

Wholesalers and distributors are vital to the global supply chain, connecting manufacturers with retailers or bulk consumers. Their role in facilitating the movement of goods allows manufacturers to focus on production and retailers to focus on sales. While the Wholesale Industry has been slow to adopt technology, recent years have seen significant disruptions.

Early adopters of technology are gaining first-mover advantage and creating significant barriers to entry for both incumbent laggards and newcomers. Disruptive e-commerce platforms like Amazon Business, eBay Wholesale, and Alibaba are transforming front-end customer touchpoints and revolutionizing goods delivery through GPS tracking and real-time delivery notifications, posing competitive challenges as well as offering collaboration opportunities.

On the operations side, technology-driven inventory management systems and data-driven decision making are creating a competitive edge for the wholesalers who align technology with their strategic objectives. As technology continues to shape the Wholesale Industry, those organizations that embrace it methodically, strategically, and innovatively will be best positioned to succeed.

This is where Build a Wholesale Business-Aligned IT Strategy comes in. An adaptation of Info-Tech’s Build a Business-Aligned IT Strategy blueprint, it keeps business vision, mission, and priorities at the center while guiding a CIO team at a Wholesale entity in formulating an IT strategy that aligns with their industry context and specific business objectives.

Manish Jain

Principal Research Director

Analyst Profile

Executive Summary

Wholesalers are facing digital disruption, but IT strategies are often ineffective.The Wholesale Industry has higher barriers of entry than retail, as it relies on trusted, and contractually obligated, long-term relationships with the partners. Despite that however, the industry is highly competitive because new-age e-commerce platforms with their inventory-light approach are causing significant disruption to the industry. Moreover, many businesses, including wholesalers, face challenges in developing an effective IT strategy, with 74.6%[1] of them struggling to do so. CIOs who fail to align their IT strategy with the business objectives encounter misalignment and prioritization issues. |

~75%[2] of CEOs value tech leaders who bring strategic perspective & operational experience, however...

Moreover, gaps in member-facing technology can be a source of shadow IT because IT is not seen as sufficiently knowledgeable or engaged with business. |

Follow Info-Tech’s approach to develop a strong IT strategy.This wholesale industry-aligned IT strategy blueprint helps you:

|

Info-Tech Insight

A CIO has three roles: run an effective and efficient IT shop, enable business productivity, and drive technology innovation. A good IT strategy must reflect these three mandates and how the IT organization strives to fulfill them.

[1]: Info-Tech, Management and Governance Diagnostic; n=1,931

[2]: CIO Journal, 2022

Wholesale & Distribution Industry – an overview

|

|

Scale of operations at a wholesale warehouse are different than a retail store, near-impossible to manage without strategic IT. |

Wholesalers & distributors purchase products from manufacturers or suppliers and sell them to a variety of purchasers – retailers, business customers, and bulk consumers. They add the value to the ecosystem by providing inventory at higher fulfilment speed and lower overhead than if the purchaser bought directly from a supplier and stored the product prior to sale or consumption.

Wholesalers range from small shops to large global companies across all verticals, such as AmerisourceBergen (pharmaceuticals), Gordon Food Service (GFS), and Associated Grocers (supermarkets).

Some wholesalers provide the logistics to ship the purchased goods. In some cases, they deal with partners, creating a complex supply and delivery chain.

US merchant wholesalers had sales1 of USD$9,671.3 billion in 2021, a 20.4% increase from USD$8,034.8 billion in 2020. While the annual sales2 in the Canadian wholesale sector grew 11.8% to CAD$973.1 billion in 2022.

In the increasingly digital era, Wholesalers are also shifting the reliance from brick-and-mortar facilities to electronic channels. As per US census estimates from Merchant Wholesalers, for years 2020 and 2021, ~30% of sales3 happened through e-commerce.

As margins in Wholesale business are very thin, a large volume is the way to sustainable business. Therefore, operational efficiency takes precedence over other business objectives. It includes improving inventory turn-over (>9), and SKU rationalization to avoid SKU proliferation and optimize the number of SKUs aligned with the demand forecast.

Sources:

[1] USA 2021 Annual Wholesale Trade Survey

[2] Canada Wholesale trade, December 2022

[3] Merchant Wholesalers (Excluding Manufacturers' Sales Branches and Offices): 2020 and 2021.

Disintermediation is the real risk in the supply chain ecosystem

Identify your organization’s role in the ecosystem, what value your organization adds, what leverage it has on the players it is connected with, and is there a risk of disintermediation?

Info-Tech Insight

Wholesalers and distributors are important cogs in the supply chain wheel. However, like many other industries, as technology drives toward new business models, wholesalers and distributors also face a risk of disintermediation i.e.., producers strive to eliminate inefficiencies and connect directly with retailers/consumers though direct-to-consumer (D2C) channels.

Organizations like Allstate (insurance) and HBO (entertainment) are circumventing traditional distribution channels by D2C channels.

Therefore, it is vital that wholesalers and distributors identify the value they add to the supply chain ecosystem and enhance it by leveraging technology.

For them, business-aligned IT strategy is the solution not only to the operating inefficiencies and new revenue channels, but also to the threat to their existence.

Key competing factors in Wholesale

|

Relationship with the manufacturer/producer and ecosystem on the supply side. From an operational perspective, wholesalers compete on:

|

|

Product, availability, delivery, and pricing on the customer side. Wholesalers must compete on the following from the purchasers’ perspective:

|

Identify the key competing factors your organization is focussing on to sustain and/or grow its position in the market.

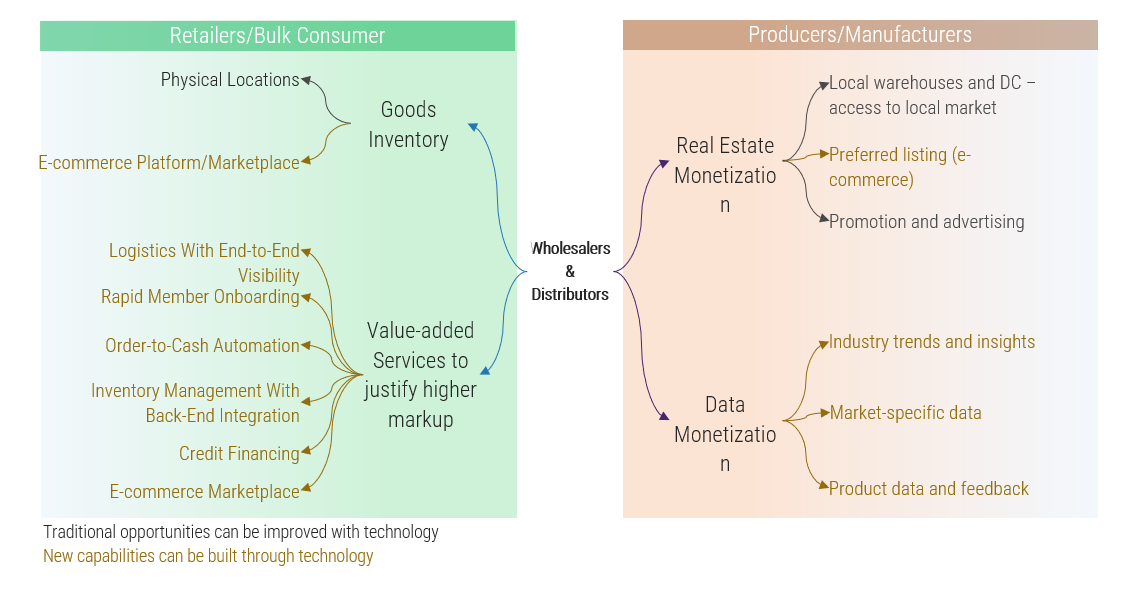

Opportunities for Wholesale ….

However, most of them find their genesis in technology

Identify what opportunities your organization is already leveraging and which ones can be the sweet spot for you without diverting too much from your organization’s vision and objectives?

Info-Tech Insight

Wholesalers can now offer more than just connecting manufacturers with retailers, thanks to emerging technological solutions. They can provide new value-added services to retailers and offer new capabilities to manufacturers by leveraging digital channels.

Furthermore, they can generate revenue by monetizing the data they collect.

However, to take advantage of these opportunities, a strategic approach to information technology is necessary.

Aligning technology with their overall business strategy is essential for wholesalers to remain competitive, drive growth, unlock new revenue streams, and create a more efficient and effective supply chain ecosystem.

Strategic opportunities IT can unlock in Wholesale

Big Data Analytics

Cloud-based analytics solutions help wholesalers manage operations more efficiently by providing insights into customer behavior, market trends, and inventory.

Internet of Things (IoT)

IoT technologies, sensors, and devices can track inventory, equipment, and shipping routes, transforming how wholesalers manage logistics, leading to greater efficiency and cost savings.

Artificial Intelligence

Machine learning (ML) and Artificial Intelligence (AI) are automating wholesale operations and enhancing decision making. ML models can analyze data, and AI-powered chatbots can handle customer inquiries.

Web and App Enabled E-Commerce

With the rapid growth of web and mobile app technologies, wholesalers can reach customers worldwide through online channels, increasing their sales.

Decentralized-Ledger Technology

DLTs (popularly know as Blockchain), although still in early stages of adoption, can enhance supply chain transparency by tracking products from manufacturer to end-user, ensuring authenticity and earning consumer trust.

Identify the key opportunities IT can unlock, and which one of them can directly be linked to the organization’s objectives.

Critical IT challenges in Wholesale

Data Integration & Analytics

Inadequate data and a siloed data infrastructure can hinder the full value of analytics.

Client-Facing Touch-Points

User interfaces need to be seamless and easy to use to provide customers with a satisfying engagement experience. If not done right, this can often lead to shadow IT as IT teams are not perceived to be sufficiently knowledgeable or responsive.

Security Validation

Security validation is a critical challenge in an ultra-connected world, and it requires following the principles of zero-trust security.

Demand Forecasting

Demand forecasting is essential to avoid carrying unnecessary inventory, but this requires developing the strong AI capability to forecast demand accurately.

Automation

The scale of wholesale operations cannot be served through manual interventions alone. Therefore, creating a governable automation capability is critical for sustained scalability.

Identify the key challenges your business is throwing at IT teams, and which one of them can directly be linked to the organization’s objectives?

Key Performance Indicators that IT in Wholesale needs to align with

Strategy: Sales, Market share, Gross margins, Operating profit, YOY growth %

- Financial & Marketing: Cost of capital, Budget accuracy, Cash conversion cycle, Account receivables, Account payables, Return on marketing investment (ROMI), Channel conversion rate (%)

- Inventory & Sales: Sales or profit per sqft, Returns over sales (%), Sales/category ($), Demand forecast accuracy, Revenue leakage, Average basket size ($), Sell-through rate, Carrying cost of inventory, Days of supply, Inventory turnover rate

- Supply Chain: Days of supply, Delivery lead time, Perfect delivery %, Order-delivery accuracy, Logistics costs per item, Supply chain costs as % of revenue, PO cycle time, PO cost, Cost of transportation, Transportation lead time

- E-commerce: Site traffic (n), New vs. returning customers, Click-through rate (%), Avg. time on site (mins), Lead conversions (%), Gross merchandise value (GMV), Sales through online channel

- Warehouse/DC Operations: Sales per warehouse, Warehouse availability, Sales/working hours, Average order size, Customer satisfaction, Stock turnover, Shrinkage, Absenteeism, Store support response time, Rent cost to sales ratio, Tracking visibility

- Partner Management: No. of supply partners, No. of logistics partners, No. of retail partners, Average supplier lead time, Days sales outstanding/ retail partner, Accounts payable/supply partner, Logistic efficiency/ logistic partner

- Information Technology: IT service levels (SLA); Total IT costs by business unit (BU); % of projects strategically aligned; % of projects on time, on budget; Time to add new SKU; System availability; % of effort in support, new projects, innovation; IT cost per warehouse/DC

— Source: Infotech Research Group Analysis

Refer Info-Tech’s The Wholesale Industry Business Reference Architecture Guide for more details.

Having a good understanding of business KPIs is vital for IT leadership to align the IT strategy with the business and earn business’ trust. Identify the KPIs that are most important to your business executives and how can you translate them into IT Initiatives.

About Info-Tech

Info-Tech Research Group is the world’s fastest-growing information technology research and advisory company, proudly serving over 30,000 IT professionals.

We produce unbiased and highly relevant research to help CIOs and IT leaders make strategic, timely, and well-informed decisions. We partner closely with IT teams to provide everything they need, from actionable tools to analyst guidance, ensuring they deliver measurable results for their organizations.

What Is a Blueprint?

A blueprint is designed to be a roadmap, containing a methodology and the tools and templates you need to solve your IT problems.

Each blueprint can be accompanied by a Guided Implementation that provides you access to our world-class analysts to help you get through the project.

Need Extra Help?

Speak With An Analyst

Get the help you need in this 4-phase advisory process. You'll receive 8 touchpoints with our researchers, all included in your membership.

Guided Implementation 1: Establish the Scope of Your IT Strategy

- Call 1: Discuss business context and customize your organization’s capability map.

- Call 2: Identify mission and vision statements and guiding principles to discuss strategy scope.

Guided Implementation 2: Review Performance Over the Past Fiscal Year

- Call 1: Assess year-in-review data and evaluate performance.

- Call 2: Discuss diagnostic data results and success stories.

Guided Implementation 3: Build Your Key Initiative Plan

- Call 1: Identify strategic initiatives and required information.

- Call 2: Discuss how to build your roadmap.

Guided Implementation 4: Define Your Operational Strategy

- Call 1: Discuss and identify appropriate operational strategy components.

- Call 2: Summarize results and plan next steps.

Author

Manish Jain

Contributors

- Denis Goulet – Senior Workshop Director, Info-Tech Research Group

- David Wallace – Vice President, Industry Research, Info-Tech Research Group

- Rahul Jaiswal – Principal Research Director, Wholesale Industry Research, Info-Tech Research Group

Unlock Build a Wholesale Business-Aligned IT Strategy

Get Instant Access

Our systems detected an issue with your IP. If you think this is an error please submit your concerns via our contact form.

This content is exclusive to members.

Get instant access by signing up!

Our systems detected an issue with your IP. If you think this is an error please submit your concerns via our contact form.

Search Code: 102339

Last Revised: July 26, 2023

TAGS:

Wholesale IT strategy, IT vision, IT mission, IT Strategy, IT Strategic Planning, Wholesale Industry, IT roadmap, strategy roadmap, key initiatives, strategic planning, business alignment, business context, guiding principles, strategy design principles, strategy performance, it success stories, support business, it excellence, drive technology innovation, operational strategy, strategic governance, stakeholder management, it budget for strategy, functional roadmap, strategy project planning, LFBook an Appointment

IT Research & Advisory Services

Our systems detected an issue with your IP. If you think this is an error please submit your concerns via our contact form.