Building the Demand-Driven Supply Chain Network in Retail

Drive better visibility and faster time to market.

- Enterprises grapple with adjusting to disruptions triggered by natural calamities, labor market conditions, regulations, and geopolitics that radically alter the global supply chain network.

- Disjoined current systems and business processes do not provide the required visibility to operate in an increasingly complex environment to remain competitive.

- Effects of the retail omnichannel ecosystem are felt in all entities. Unified functions work differently and require new mindsets, models, and capabilities.

- Businesses need a broad strategy to address evolving demand-driven supply chain network needs.

Our Advice

Critical Insight

Most demand-driven networks still run on dated industry business reference architectures in the digital era. Enterprises must prioritize nimble cloud-based, AI-enabled planning platforms with self-directed analytics execution capability tools. By combining real-time scenarios, monitoring business activity, and securing data infrastructure, these tools will inject demand-driven supply chains with visibility and improve their costs and competitiveness.

Impact and Result

- Gain valuable perspective on the enablers for better visibility in the supply chain to capitalize on the network.

- Discover how the best-in-class businesses are managing greater supply chain complexity while striving for greater network visibility.

- Realize opportunities across your network to capitalize on the streamlined supply chain and deliver customer service excellence to monetize key customer insights.

- Envision strategies and technologies effectively to become a more demand-driven, cost-responsive, and competitive network. Then design a list of initiatives to integrate into the IT strategic plan.

Building the Demand-Driven Supply Chain Network in Retail Research & Tools

1. Building the Demand-Driven Supply Chain Network in Retail Storyboard – Research to help you become a more demand-driven, cost-effective, and competitive network.

Use this deck to:

- Gain valuable perspective on the enablers for better visibility in the supply chain to capitalize on the network.

- Discover how best-in-class businesses manage greater supply chain complexity while striving for greater network visibility.

- Realize opportunities across your network to capitalize on the streamlined supply chain and deliver customer service excellence to monetize key customer insights.

- Design a list of initiatives to integrate into the business-aligned IT strategic plan.

Building a Demand-Driven Supply Chain Network in Retail

Drive better visibility and faster time to market.

Analyst Perspective

Omnichannel (demand-driven) fulfillment drives better visibility and faster time to market.

Buyers continue to become more empowered using technologies across all channels, positioning. omnichannel demand-driven fulfillment to drive supply chain networks. Therefore, businesses need to know what buyers value; operating models and new customer service levels should be organized in response to the demand signals.

The demand-driven fulfillment cycle must emphasize customer demand to increase the return on investment. It begins with sensing market prospects through customer intelligence from internal loyalty member transactions and lifetime value scores. Using this information, businesses can shape merchandising strategies that improve brand loyalty and profitability.

These customer insights can be used to design and launch innovative products and services that match prevailing assortments and eventually shape the future of demand-driven omnichannel fulfillment. Reacting to demand attained using synchronized replenishment sourcing and logistics processes through a dynamically shaped partner ecosystem network will allow for a trade-off between lead time and cost.

Rahul Jaiswal

Principal Research Director, Retail

Info-Tech Research Group

Executive Summary

Your ChallengeYou are experiencing disruptions triggered by natural calamities, labor market conditions, regulations, and geopolitics that radically alter the global supply chain network. Your systems are disjointed, and business processes don't provide the required visibility to operate competitively in an increasingly complex environment. You are feeling the effects of the omnichannel ecosystem across all entities. Unified functions work differently and require new mindsets, models, and capabilities. Your business needs a broad strategy to address evolving demand-driven supply chain network needs. |

Common ObstaclesInability to precisely forecast leads to poor customer service and insufficient leftover inventory to address short lead time customer order adjustments. Poor integration with current systems results in duplicate entries and lack of coordination. Low inventory visibility across channels makes it necessary to carry excess "buffer" inventory. Changing operating models requires flexible and responsive omnichannel setups, but legacy and siloed systems make it difficult to manage the changes that would support supply chain visibility. |

Info-Tech's ApproachGain valuable perspective on the enablers for better supply chain visibility to capitalize on the network. Discover how best-in-class businesses are managing greater supply chain complexity while striving for greater network visibility. Realize opportunities across your network to capitalize on the streamlined supply chain and deliver customer service excellence to monetize key customer insights. Envision strategies and technologies effectively to create a more demand-driven, cost-responsive, and competitive network. Then, design a list of initiatives to integrate into the IT strategic plan. |

Info-Tech Insight

Most demand-driven networks still run on dated industry business reference architecture in the digital era. Enterprises must prioritize nimble, cloud-based, AI-enabled planning platforms with self-directed analytics execution capabilities.

Enterprises are adjusting to disruptions in the global supply chain network

Key supply chain challenges impacting the retail industry

Disruptions, shortages, and workforce constraints are key supply chain challenges.

Over 50% of surveyed supply chain professionals said they found supply chain disruptions and shortages challenging. Demand-side challenges, such as faster response time, were cited among the most significant challenges.

Source: MHI via Statista, 2021; N=1,074 supply chain professionals worldwide.

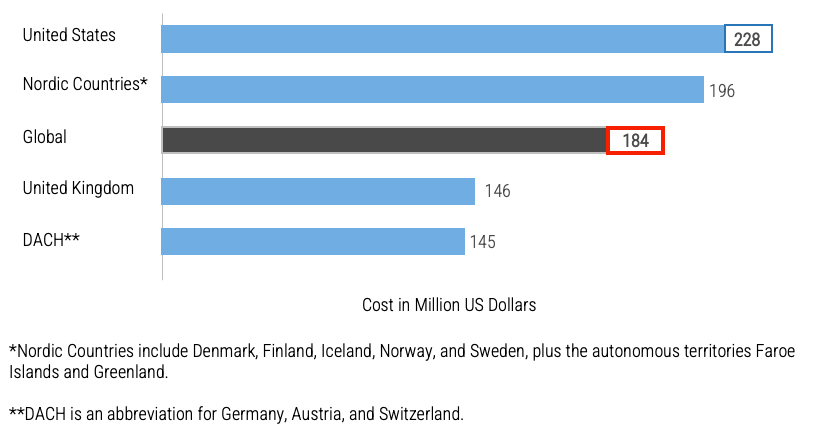

Est. average annual cost to businesses due to global supply chain disruptions

Supply chain disruptions cost organizations an average of US$184 million.

Supply chain disturbances create economic adversity, costing businesses worldwide US$184 million per year on average, according to a 2021 study by Interos. The financial problem is highest in the United States, where the assessed average annual cost of respondents' businesses amounted to US$228 million.

Source: Interos, 2021; N=900 senior IT, IT security, and procurement decision makers.

Omnichannel fulfillment will drive retail supply chain network

Share of retail supply chain executives willing to increase investments

Omnichannel fulfillment and planning are the strongest investment goals in the retail supply chain.

The pandemic, labor conditions, and the Russia-Ukraine war motivated decision makers in the retail and consumer goods industry to capitalize more on omnichannel demand-driven fulfillment. This is the priority for 58.6% of respondents, followed by higher investment in effective planning and demand forecasting.

Source: "Investment intentions in the retail supply chain," Statista, 2022; N=70 retail and consumer goods supply chain executives in the US.

Leading to new omnichannel (demand-driven) fulfillment models

In-store fulfillment leads operational models planned in the next two to three years.

Fifty-nine percent of surveyed senior logistics executives in retail and e-commerce fulfillment said they planned to invest in in-store fulfillment. To ensure higher flexibility and profitability, stores are becoming small fulfillment centers and strategic in omnichannel.

Source: "Which of the following fulfillment options do you plan to have in the next 2-3 years," Statista, 2022; N=286 respondents worldwide.

Businesses are investing in order fulfillment services automation

Share of investments in omnichannel fulfillment services

Order management is the most common current investment goal in omnichannel execution.

Order management system investments are prioritized by more than 50% of retail brands in the US. An OMS tracks sales, orders, inventory, and fulfillment and enables the supply chain to get the product to the customer. If the OMS of a retailer isn't current, this may stall that retailer's omnichannel capabilities. In addition, warehouse management and store task systems are also prioritized by many retailers when investing in omnichannel.

Source: "Omnichannel retail in the United States," Statista, 2023.

Leading to automation technology priorities toward reforming retail processes

Automation will modernize and streamline retail processes within three years.

Automation in retail is expected to become increasingly prevalent in the coming years. Companies are observing which processes can be automated. Automation can improve the efficiency of processes crucial for omnichannel, such as order fulfillment and inventory availability. It is also being used to solve some of the sore points experienced by shoppers, such as customer service.

Businesses are already leveraging fulfillment automation technologies

Awareness |

Considerations |

Transactions |

Delivery |

Engagement |

Shein's AI engine swiftly detects variations in awareness demand of new trends. Its supply chain reacts in real time, giving customers more value and greatly reducing the brand's operating costs. Shein cut the time to create a collection and deliver it to customers from three weeks to just a few days. Source: PSFK iQ. |

Nordstrom leverages robotics, partnering with Tompkins Robotics Systems to design and deploy parcel sortation. Nordstrom's item sortation employs robots to fulfill orders for parcel and carton shipping sortation to outbound carriers and modes. Source: Retail Info Systems. |

Shake Shack started a bitcoin rewards program. It became one of the first fast-casual chains to adopt bitcoin when it debuted a limited-time rewards deal in March 2022. Bitcoin booster was bundled with payment. Shake Shack awarded a 15% refund in Bitcoin when customers paid with Cash App's Cash Card or the Cash Boost rewards program. Source: Street Fight. |

Amazon Prime Air deploys drones for delivery. Amazon delivery service has secured Federal Aviation Administration approval. Having fully autonomous drone approval in place does not entitle the company to operate drone delivery far and wide. But it takes the company a step closer to last-mile delivery execution. Source: SDC. |

Trendsi's chain platform reduces excess inventory by 20-30% and business costs by 11% of revenues, managing inventory with no minimums and fulfilling orders. Trendsi's AI commerce platform utilizes just-in-time techniques, aided by machine learning capabilities, to predict sales and guide product trade Source: Forbes. |

Zara incorporates Tyco microchips into its clothing security tags to identify where a particular style and size are located within the supply chain. Zara's forecasting analytics allow complete visibility of the inventory it can sell, thereby informing its supply chain network. Source: Thomas Insights. |

Carrefour increases customer trust using blockchain as it tracks meat, milk, and fruit from farm to store. Blockchain technology informs their customers and improves customers' confidence in products. Carrefour QR codes provide product information about where/when the product was harvested, whether it contains pesticides, etc. Source: Reuters. |

IKEA facilitates blockchain payments; it began using smart contracts on the Ethereum blockchain to facilitate payments from retailers in Iceland. IKEA traces carbon footprints on the blockchain and can track details about item production journeys, components, and materials. Source: Street Fight. |

Fleet Farm deployed price management analytics for merchandising services via Engage3's cloud- and mobile-based solution to expand omnichannel visibility and analytics. A machine learning (ML) powered product linking solution enables Fleet Farm to track its price position via the item catalog and identify risks and opportunities to improve its price image. Source: Retail Customer Experience. |

Starbucks' blockchain digital collaboration is unique from any other company, using the technology to create a new global digital ecosystem defined by community, experiences, and shared ownership. Starbucks' NFT collections and memberships are backed by the blockchain, with a central focus on coffee art and storytelling. Source: Starbucks Stories & News. |

About Info-Tech

Info-Tech Research Group is the world’s fastest-growing information technology research and advisory company, proudly serving over 30,000 IT professionals.

We produce unbiased and highly relevant research to help CIOs and IT leaders make strategic, timely, and well-informed decisions. We partner closely with IT teams to provide everything they need, from actionable tools to analyst guidance, ensuring they deliver measurable results for their organizations.

What Is a Blueprint?

A blueprint is designed to be a roadmap, containing a methodology and the tools and templates you need to solve your IT problems.

Each blueprint can be accompanied by a Guided Implementation that provides you access to our world-class analysts to help you get through the project.

Talk to an Analyst

Our analyst calls are focused on helping our members use the research we produce, and our experts will guide you to successful project completion.

Book an Analyst Call on This Topic

You can start as early as tomorrow morning. Our analysts will explain the process during your first call.

Get Advice From a Subject Matter Expert

Each call will focus on explaining the material and helping you to plan your project, interpret and analyze the results of each project step, and set the direction for your next project step.

Unlock Sample ResearchAuthor

Rahul Jaiswal

Contributors

- Rajiv Shankar, Chief Information Officer, REDTAG

- Laura Becker, Enterprise Architect, Qurate Retail Group

- Mitch Ruebush, Director of Enterprise Architecture, Qurate Retail Group

- Anitha Reddy, Vice President of Software Engineering, Qurate Retail Group

- Prabhu Sundararajan, Director IT, Qurate Retail Group

- Aiman Ali, Director of Applications, Al-Nahdi Group

- Khalid Tadlaoui, Chief Information Officer, Al-Nahdi Group

- Cherokee Chamorro, Client Leader, Vancouver Canada

- Nastaran Bisheban, Chief Technology Officer, KFC Canada

Unlock Building the Demand-Driven Supply Chain Network in Retail

Get Instant Access

Our systems detected an issue with your IP. If you think this is an error please submit your concerns via our contact form.

This content is exclusive to members.

Get instant access by signing up!

Our systems detected an issue with your IP. If you think this is an error please submit your concerns via our contact form.

Search Code: 101610

Last Revised: May 29, 2023

TAGS:

retail, wholesale, demand-driven, retail supply chain, supply chain network, omnichannel, retail fulfillment, demand-driven network, demand-driven supply chain fulfillment strategies, omnichannel fulfillment, merchandising strategies, omnichannel ecosystem, retail supply chain challenges, supply chain disruptions cost, retail supply chain investments, retail supply chain models, in-store fulfillment, e-com fulfillment centers, micro-fulfillment centers, pop-up distribution centers, dark stores, demand forecasting, order management system, order fulfillment, product information, warehouse management automation, fulfillment automation, blockchain, robotics, demand-driven fulfillment cycle, connected supply chain, precise demand management, improved data quality, increased productivity, faster time to market, better supplier visibility, omnichannel-centric supply chain, 360-degree customer view, omni-channel inventory, omni-channel maturity. business reference architecture., LFBPBook an Appointment

IT Research & Advisory Services

Our systems detected an issue with your IP. If you think this is an error please submit your concerns via our contact form.

Speak With A Representative

Request Content Access

Our systems detected an issue with your IP. If you think this is an error please submit your concerns via our contact form.

%202023%20from%20an%20IT%20Perspective%20%7C%20Info-Tech%20Research%20Group&_biz_n=4&rnd=141850&cdn_o=a&_biz_z=1753823934897)