Enhance the Guest Experience Through Payments Modernization

Digital Transformation Technology Report

Speak With A Representative

Request Content Access

Our systems detected an issue with your IP. If you think this is an error please submit your concerns via our contact form.

- The payment landscape is evolving rapidly. Digital transformation has made its way into the payments environment, and by extension, the gaming and hospitality industry has been given a key role in digitizing their own payment services.

- Your current payment process is in a legacy state which will not survive in a digital-first environment.

- Your customers demand a modern and seamless payment experience. Removing friction becomes a priority to retain guests and reduce dissatisfaction.

Our Advice

Critical Insight

The gaming and hospitality industry’s role in orchestrating digitally transformed payment flows have become crucial with the value of payments shifting from basic processing functionality to a modern and seamless payments experience. Without providing a strategically selected solution for the “last mile,” guests and operators cannot benefit from payment innovations.

Impact and Result

- Understand how digital transformation is impacting major payment stakeholders: customers, operators, and payment service providers.

- Learn about value-added services and key features and functions that are necessary for digitally transformed payment processes.

- Gauge the current capabilities of leading payment vendors in the space and how they fare in this digital-first world.

Enhance the Guest Experience Through Payments Modernization Research & Tools

1. Enhance the Buyer Experience Through Payments Modernization – A Digital Transformation Technology Report.

An insightful report that illustrates the impact of digital transformation on major payment stakeholders and gauges the current capabilities of leading payment vendors in the gaming and hospitality space.

2. Gaming & Hospitality Payment Service Provider Shortlist Tool – Identify the PSP that best meets your payment strategy.

Develop a shortlist of payment service providers to speed the selection process.

Speak With A Representative

Request Content Access

Our systems detected an issue with your IP. If you think this is an error please submit your concerns via our contact form.

Enhance the Guest Experience Through Payments Modernization

Digital Transformation Technology Report

Analyst Perspective

Drive seamless payment experiences online and on-property

The payments industry is in the midst of a significant digital transformation, accelerated by the pandemic. By extension, the gaming and hospitality industry has been given a key role in digitizing their own payment services and fostering the inclusion of different payment innovations as the day-to-day financial experiences of guests and players become enhanced.

Any advantage an operator wants to take relies on the payment service provider (PSP). To achieve greater success, an operator needs to look past basic functionality and low transactional fees as reasons for selecting a PSP. To achieve greater success, your PSP must be fully involved in creating an end-to-end digital processing environment that is in sync to provide compatibility with third-parties for the enablement of value-added services.

Monica Pagtalunan

Research Analyst, Gaming & Hospitality Research Center (GHRC)

Info-Tech Research Group

Executive Summary

Your ChallengeThe payment landscape is evolving rapidly. Digital transformation has made its way into the payments environment, and by extension, the gaming and hospitality industry has been given a key role in digitizing their own payment services. Your current payment process is in a legacy state which will not survive in a digital-first environment. Your customers demand a modern and seamless payment experience. Removing friction becomes a priority to retain guests and reduce dissatisfaction. | Common ObstaclesManagement concentrates on accepting payment vs. whole offer. It is common for operators to assess a PSP based on the provision of its basic function – accepting a payment. Vendor selection process has too much focus on lowest transaction fees. A secondary issue is focusing solely on vendor fees, which creates further risks and threats for the business. Focus on current state over future state. There is a tremendous level of innovation occurring in payments. A PSP plays a substantial role in the digital transformation of this industry. | Info-Tech’s ApproachUnderstand how digital transformation is impacting major payment stakeholders: customers, operators, and payment service providers. Learn about changes in the PSP ecosystems as many vendors are developing key features and functions that are necessary for digitally transformed payment processes. Gauge the current capabilities of leading payment vendors in the space and how they fare in this digital-first world. |

Info-Tech Insight

The gaming and hospitality industry’s role in orchestrating digitally transformed payment flows have become crucial with the value of payments shifting from basic processing functionality to a modern and seamless payments experience. Without providing a strategically selected solution for the “last mile,” guests and operators cannot benefit from payment innovations.

The payment process is the last mile

The last mile is the final leg of the customer’s journey and the narrowest part of the experience funnel. In the context of online, it’s the check-out page where your customers hit “buy” and they enter their payment details before completing the purchase. In the context of on-property, it’s the check-out process where customers are waiting in line to reach an employee or machine to pay.

Your customer is making a purchase at this stage. Consider the POS technology, different payments offered, and the customer-facing employees that are involved at this stage. Customer expectations involve an enhanced experience. Your guests and players are anticipating cutting-edge capabilities and smooth payment experiences.

The last mile can leave a lasting impression. The experience isn’t over yet. Customers can be turned off by any variable – it can be too many steps in the process, insufficient payment options, the data inputs required, or the ultimate acceptance or denial of a payment.

Enhance the Last Mile Experience With the Right Payment Service Provider (PSP)

The gaming and hospitality industry’s role in orchestrating digitally transformed payment flows has become crucial with the value of payments shifting from basic processing functionality to a modern and seamless payments experience. Without providing a strategically selected solution for the “last mile” in the experience funnel, guests and operators cannot benefit from payment innovations.

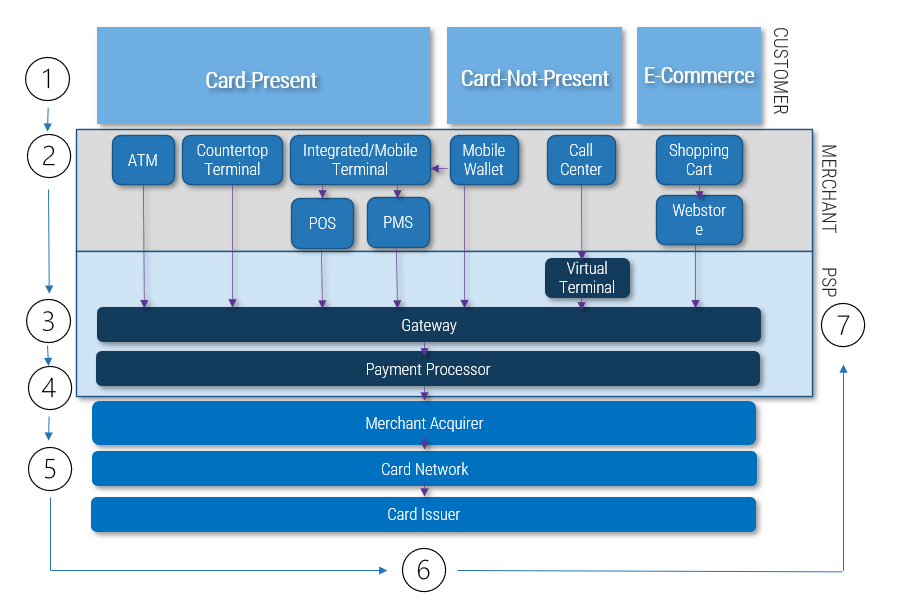

Define the payment flow stakeholders

Break down the payment flow

Distinguishing authorization transactions by card present, card-not-present, and e-commerce

| The Payment Flow

|

Determine what value your payment process creates

Value streams and value chains connect business goals to the organization’s value realization activities. They enable an organization to create and capture value in the marketplace by engaging in a set of interconnected activities. Your payment process creates value by servicing and retaining guests (value stream) through the following payment process activities (value chains):

Value Streams: A value stream refers to the specific set of activities an industry player undertakes to create and capture value for and from the end consumer.

Value Chains: A value chain is a ”string” of processes within a company that interrelate and work together to meet market demand. Examining the value chain of a company will reveal how it achieves competitive advantage. Each value chain has a stakeholder associated with it. This is the primary stakeholder that seeks to gain value from that value chain.

Visit GHRC’s Integrated Casino Industry Reference Architecture

Info-Tech Insight

There seems to be a misperception that digitally transformed payments solely impact online channels. The last mile is an on-property challenge too. A more pronounced payment process at the POS involves contactless payments, enhanced authorization, and fraud and chargeback mitigation solutions.

The gaming and hospitality industry’s last mile remains traditional

A legacy stack risks the customer journey from pushing forward

The customer is interested in purchasing a product or service from the business…. |

|

…but finds the payment experience underwhelming… |

|

…and either abandons the purchase and/or is dissatisfied with the process… |

|

…all while the operator deals with their own set of issues. |

|

Infrastructure must keep pace with demand for cashless

The use of cashless is projected to increase. The pandemic reinforced major shifts in payment behavior: declining cash usage, increase in online commerce and engagement, and adoption of instant payments.

Cashless forces a change in payment infrastructure, bringing in a new and merging mix of payment types (Illustration on the right). These cashless payment types are enabled by merchant-level payment systems including on-property point-of-sale (enabled credit and debit, RFID, NFC) or contactless (mobile applications, electronic wallets, online browsers).

Increase revenue and efficiency while shedding light on valuable insights by providing an array of cashless types. Limiting payment options can reduce customer buying power and make it more likely that they will go elsewhere. Leveraging cashless payment types makes sense since they dominate the payments industry and create an incredibly fast payment process. A bonus is the data that cashless provides. Unlike cash, cashless payment types can shed light on customer trends including behaviors, transactions, and preferences even outside the four walls of your property.

Cash service rebate is an incentive that still inhibits the push to cashless. Cash is the only payment method that doesn’t charge fees and may undermine motivations to force this necessary change in payment infrastructure. Further, cashless payment types vary in fees. The higher the fee, the less likely an operator will choose to include it in their mix. In the case your payment processor is also your cash service provider, your organization has the risk of vendor lock-in as well.

About Info-Tech

Info-Tech Research Group is the world’s fastest-growing information technology research and advisory company, proudly serving over 30,000 IT professionals.

We produce unbiased and highly relevant research to help CIOs and IT leaders make strategic, timely, and well-informed decisions. We partner closely with IT teams to provide everything they need, from actionable tools to analyst guidance, ensuring they deliver measurable results for their organizations.

What Is a Blueprint?

A blueprint is designed to be a roadmap, containing a methodology and the tools and templates you need to solve your IT problems.

Each blueprint can be accompanied by a Guided Implementation that provides you access to our world-class analysts to help you get through the project.

Talk to an Analyst

Our analyst calls are focused on helping our members use the research we produce, and our experts will guide you to successful project completion.

Book an Analyst Call on This Topic

You can start as early as tomorrow morning. Our analysts will explain the process during your first call.

Get Advice From a Subject Matter Expert

Each call will focus on explaining the material and helping you to plan your project, interpret and analyze the results of each project step, and set the direction for your next project step.

Unlock Sample ResearchAuthor

Monica Pagtalunan

Contributors

- 6 anonymous contributors

Unlock Enhance the Guest Experience Through Payments Modernization

Get Instant Access

Our systems detected an issue with your IP. If you think this is an error please submit your concerns via our contact form.

This content is exclusive to members.

Get instant access by signing up!

Our systems detected an issue with your IP. If you think this is an error please submit your concerns via our contact form.

Search Code: 100777

Last Revised: February 9, 2023

TAGS:

Payment service provider, PSP, Gaming payment, hotel payment, payment processer, payment gateway, merchant acquirer, alternative payment methods, Buy Now Pay Later, mobile wallet, digital wallet, cashless, crypto wallet, banking card, Adyen, Amadeus, Elavon, Everi, Fiserv, First Data, Global Payments, JPMorgan & Chase, NRT Technology, Nuvei, Paysafe, Shift4, Worldpay, FISBook an Appointment

IT Research & Advisory Services

Our systems detected an issue with your IP. If you think this is an error please submit your concerns via our contact form.

%20%7C%20Info-Tech%20Research%20Group&_biz_n=2&rnd=869457&cdn_o=a&_biz_z=1744914706510)