Unlock Position and Agree on ROI to Maximize the Impact of Data and Analytics

Get Instant Access

Our systems detected an issue with your IP. If you think this is an error please submit your concerns via our contact form.

Our systems detected an issue with your IP. If you think this is an error please submit your concerns via our contact form.

Position and Agree on ROI to Maximize the Impact of Data and Analytics

Data and analytics ROI strategy is based on the business problem being solved and agreed-upon value being generated.

- Because ROI is a financial concept, it can be difficult to apply ROI to anything that produces intangible value.

- It is a lot harder to apply ROI to functions like data and analytics than it is to apply it to functions like sales without misrepresenting its true purpose.

Our Advice

Critical Insight

- The standard ROI formula cannot be easily applied to data and analytics and other critical functions across the organization.

- Data and analytics ROI strategy is based on the business problem being solved.

- The ROI score itself doesn’t have to be perfect. Key decision makers need to agree on the parameters and measures of success.

Impact and Result

- Agreed-upon ROI parameters

- Defined measures of success

- Optimized ROI program effectiveness by establishing an appropriate cadence between key stakeholders

Position and Agree on ROI to Maximize the Impact of Data and Analytics Research & Tools

1. Data and Analytics ROI Strategy Deck – A guide for positioning ROI to maximize the value of data and analytics.

This research is meant to ensure that data and analytics executives are aligned with the key business decision makers. Focus on the value you are trying to achieve rather than perfecting the ROI score.

This research includes a guide on how to approach ROI when it comes to data and analytics. It also contains a ROI strategy mapping tool to complement the activity mentioned in the research.

2. Data and Analytics Service to Business ROI Map – An aligned ROI approach between key decision makers and data and analytics.

A tool to be used by business and data and analytics decision makers to facilitate discussions about how to approach ROI for data and analytics.

Position and Agree on ROI to Maximize the Impact of Data and Analytics

Data and analytics ROI strategy is based on the business problem being solved and agreed-upon value being generated.

Analyst Perspective

Missing out on a significant opportunity for returns could be the biggest cost to the project and its sponsor.

|

|

This research is directed to the key decision makers tasked with addressing business problems. It also informs stakeholders that have any interest in ROI, especially when applying it to a data and analytics platform and practice. While organizations typically use ROI to measure the performance of their investments, the key to determining what investment makes sense is opportunity cost. Missing out on a significant opportunity for return could be the biggest cost to the project and its sponsor. By making sure you appropriately estimate costs and value returned for all data and analytics activities, you can prioritize the ones that bring in the greatest returns. |

|---|---|---|

| Ibrahim Abdel-Kader Research Analyst, Data & Analytics Practice Info-Tech Research Group |

Ben Abrishami-Shirazi Technical Counselor Info-Tech Research Group |

Executive Summary – ROI on Data and Analytics

Your Challenge |

Common Obstacles |

Info-Tech’s Approach |

|---|---|---|

Return on investment (ROI) is a financial term, making it difficult to articulate value when trying to incorporate anything that produces something intangible. The more financial aspects there are to a professional function (e.g. sales and commodity-related functions), the easier it is to properly assess the ROI. However, for functions that primarily enable or support business functions (such as IT and data and analytics), it is a lot harder to apply ROI without misrepresenting its true purpose. |

|

Approach ROI for data and analytics appropriately:

|

Info-Tech Insight

ROI doesn’t have to be perfect. Parameters and measures of success need to be agreed upon with the key decision makers.

Glossary

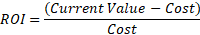

Return on Investment (ROI): A financial term used to determine how much value has been or will be gained or lost based on the total cost of investment. It is typically expressed as a percentage and is supported by the following formula:

Payback: How quickly money is paid back (or returned) on the initial investment.

Business Problem Owner (BPO): A leader in the organization who is accountable and is the key decision maker tasked with addressing a business problem through a series of investments. BPOs may use ROI as a reference for how their financial investments have performed and to influence future investment decisions.

Problem Solver: A key stakeholder tasked with collaborating with the BPO in addressing the business problem at hand. One of the problem solver’s responsibilities is to ensure that there is an improved return on the BPO’s investments.

Return Enhancers: A category for capabilities that directly or indirectly enhance the return of an investment.

Cost Savers: A category for capabilities that directly or indirectly save costs in relation of an investment.

Investment Opportunity Enablers: A category for capabilities that create or enable a new investment opportunity that may yield a potential return.

Game Changing Components: The components of a capability that directly yield value in solving a business problem.

ROI strategy on data and analytics

ROI roles

Typical roles involved in the ROI strategy across the organization

CDOs and CAOs typically have their budget allocated from both IT and business units.

This is evidenced by the “State of the CIO Survey 2023” reporting that up to 63% of CDOs and CAOs have some budget allocated from within IT; therefore, up to 37% of budgets are entirely funded by business executives.

This signifies the need to be aligned with peer executives and to use mechanisms like ROI to maximize the performance of investments.

Source: Foundry, “State of the CIO Survey 2023.”

About Info-Tech

Info-Tech Research Group is the world’s fastest-growing information technology research and advisory company, proudly serving over 30,000 IT professionals.

We produce unbiased and highly relevant research to help CIOs and IT leaders make strategic, timely, and well-informed decisions. We partner closely with IT teams to provide everything they need, from actionable tools to analyst guidance, ensuring they deliver measurable results for their organizations.

What Is a Blueprint?

A blueprint is designed to be a roadmap, containing a methodology and the tools and templates you need to solve your IT problems.

Each blueprint can be accompanied by a Guided Implementation that provides you access to our world-class analysts to help you get through the project.

Talk to an Analyst

Our analyst calls are focused on helping our members use the research we produce, and our experts will guide you to successful project completion.

Book an Analyst Call on This Topic

You can start as early as tomorrow morning. Our analysts will explain the process during your first call.

Get Advice From a Subject Matter Expert

Each call will focus on explaining the material and helping you to plan your project, interpret and analyze the results of each project step, and set the direction for your next project step.

Unlock Sample ResearchAuthors

Ibrahim Abdel-Kader

Ben Abrishami-Shirazi

Related Content: Data Management

Unlock Position and Agree on ROI to Maximize the Impact of Data and Analytics

Get Instant Access

Our systems detected an issue with your IP. If you think this is an error please submit your concerns via our contact form.

This content is exclusive to members.

Get instant access by signing up!

Our systems detected an issue with your IP. If you think this is an error please submit your concerns via our contact form.

Search Code: 101616

Last Revised: May 29, 2023

Book an Appointment

IT Research & Advisory Services

Our systems detected an issue with your IP. If you think this is an error please submit your concerns via our contact form.

Establish an Analytics Operating Model

Establish an Analytics Operating Model

Create and Manage Enterprise Data Models

Create and Manage Enterprise Data Models

Build a Robust and Comprehensive Data Strategy

Build a Robust and Comprehensive Data Strategy

Mandate Data Valuation Before It’s Mandated

Mandate Data Valuation Before It’s Mandated

Position and Agree on ROI to Maximize the Impact of Data and Analytics

Position and Agree on ROI to Maximize the Impact of Data and Analytics

Create a Data Management Roadmap

Create a Data Management Roadmap

Establish Data Governance

Establish Data Governance

Build a Data Architecture Roadmap

Build a Data Architecture Roadmap

Build a Data Integration Strategy

Build a Data Integration Strategy

Build a Data Pipeline for Reporting and Analytics

Build a Data Pipeline for Reporting and Analytics

Build Your Data Quality Program

Build Your Data Quality Program

Mitigate Machine Bias

Mitigate Machine Bias

Design Data-as-a-Service

Design Data-as-a-Service

Create an Architecture for AI

Create an Architecture for AI

Get Started With Artificial Intelligence

Get Started With Artificial Intelligence

Go the Extra Mile With Blockchain

Go the Extra Mile With Blockchain

Understand the Data and Analytics Landscape

Understand the Data and Analytics Landscape

Select Your Data Platform

Select Your Data Platform

Build Your Data Practice and Platform

Build Your Data Practice and Platform

Establish Data Governance – APAC Edition

Establish Data Governance – APAC Edition

Foster Data-Driven Culture With Data Literacy

Foster Data-Driven Culture With Data Literacy

Generative AI: Market Primer

Generative AI: Market Primer

Establish Effective Data Stewardship

Establish Effective Data Stewardship

Identify and Build the Data & Analytics Skills Your Organization Needs

Identify and Build the Data & Analytics Skills Your Organization Needs

Promote Data Literacy in Your Organization

Promote Data Literacy in Your Organization

Define a Data Practice Strategy to Power an Autonomous Enterprise

Define a Data Practice Strategy to Power an Autonomous Enterprise