This content requires an active subscription.

Contact one of our representatives for assistance.

+1-519-432-3550 (International)

Industry Insights Designed to Help You Lead Digital Transformation

With Info-Tech's Industry Roundtables & Benchmarking, you will never again wonder "what are my peers doing?", "how do I compare?", or "what should I be doing?".

Industry Insights & Best Practices

- Industry-Specific Research

- Reference Architectures

- Industry Trends

- Top Technologies

Executive Peer Groups

- Executive Collaboration

- Peer-to-Peer Knowledge Sharing

- High-Impact Discussion Topics

Industry-Specific Advisory Services

- Digital Transformation

- Linking Business & IT Value Maps

- Advisory Assistance to Help You Build Your IT Strategy

- Peer Benchmarking

Industry Roundtable Events

Retail Banking - Critical Projects

Deep Insights Tailored to Your Industry

1

Business-Aligned IT Strategy

Understand the capabilities and focus areas required to meet your industry’s needs and enable value creation.

2

Top Industry Trends

Identify resource, process, and environmental trends impacting your industry. Implement strategies to mitigate specific risks and take advantage of all relevant opportunities.

3

Industry Benchmarking

Reveal the true state of your IT services, processes, spend, and staffing levels to align your priorities and resources. Benefit from peer data to get a reference point for how well you stack up.

4

Core Industry Technologies & Software Selection

Arm yourself with everything you need to provide the right solutions to meet the needs of your business stakeholders.

1

Business-Aligned IT Strategy

Strategy Alignment

Consider Agile for Banking

For many banks, the Waterfall development approach is still relevant due to the highly regulated nature of the industry and its products and services. Agile can be used in certain areas of your bank in conjunction with Waterfall if you:

Strategy Alignment

Priorities for Adopting an Exponential IT Mindset in the Banking Industry

- Recognize the urgency of adopting Exponential IT. Your bank must start the conversation now on how Exponential IT will change banking to begin making the significant changes required.

- Understand the five priorities of Exponential IT transformation. There are five areas of focus that you must focus on as your bank develops its Exponential IT capabilities.

- Build the foundational capabilities and maturity required to begin an effective Exponential IT transformation that results in value creation.

Strategy Alignment

Third-Party Data in Retail Banking

Understand what data is available. Having a good understanding of third-party data is essential before your bank begins its journey.

Introduce customer data platforms to establish governance and control of customer data. Sophisticated platforms exist to host and organize customer data and to help drive insights needed to create new customer-centric products and services.

Understand how third-party data is evolving and how to prepare for AI’s impact. New regulations are reshaping third-party data at the same time AI capabilities are revolutionizing data-based insights.

Strategy Alignment

Build a Retail Banking Business-Aligned IT Strategy

- Establish the scope of your IT strategy by defining IT’s mission and vision statements and guiding principles.

- Perform a retrospective of IT’s performance to recognize the current state while highlighting important strategic elements to address going forward.

- Elicit the business context and identify strategic initiatives that are most important to the organization while building a plan to execute it.

- Evaluate the foundational elements of IT’s operational strategy that will be required to successfully execute key initiatives.

- Wrap all strategic information into a highly visual and compelling presentation that enables easy customization and executive-facing content.

Strategy Alignment

Meet the Technology Demands of Modern Banking

Better understand the current market challenges. We focus on issues related to the challenges that core banking systems encounter when trying to deliver modern banking products, services and experiences.

Identify the four of the most popular core banking system modernization approaches, including a 12 criteria approach to evaluate the suitability of the 4 methodologies is provided.

A scorecard based evaluation tool will help you make a disciplined and data driven decisions about the modernization methodology that best suits your bank.

Strategy Alignment

Next-Generation Customer Experience in Retail Banking

Next-generation customer experience requires the entire organization to achieve; it isn’t just a technology solution. Improved customer experience will elevate:

- Engagement

- Brand

- Value

- Loyalty

- Retention

- Profitability

The ultimate goal of modernized CX in retail banking is to assure that, regardless of the channel selected, experiences are fast, relevant, personalized, and leave the customer feeling more connected to their bank.

Strategy Alignment

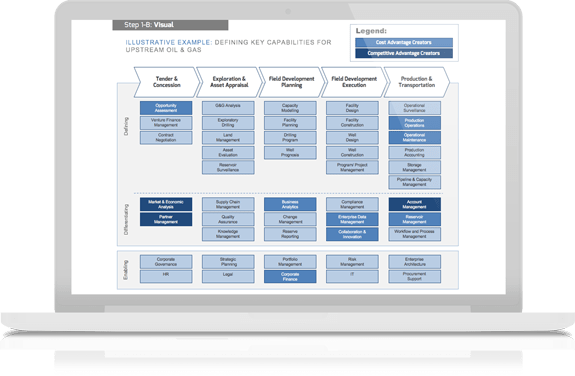

Retail Banking Industry Business Reference Architecture

- Demonstrate the value of IT’s role in supporting your banking organization’s capabilities while highlighting the importance of proper alignment between organizational and IT strategies.

- Apply reference architecture techniques such as strategy maps, value streams, and capability maps to design usable and accurate blueprints of your retail banking operations.

- Assess your initiatives and priorities to determine if you are investing in the right capabilities. Conduct capability assessments to identify opportunities and to prioritize projects.

Strategy Alignment

Make Your IT Governance Adaptable – Financial Services

- You will produce more value from IT by developing a governance framework optimized for your current needs and context, with the ability to adapt as your needs shift.

- You will create the foundation and ability to delegate and empower governance to enable agile delivery.

- You will identify areas where governance does not require manual oversight and can be embedded into the way you work.

2

Top Industry Trends

Top Trends

Explore AI and AI-Related Use Cases for Credit Unions and Small Banks

Info-Tech can support you in AI roadmapping, data maturation, and ongoing bias mitigation efforts.

This AI use case library will help you:

- Identify potential sources of value to strategically operationalize use case capabilities.

- Jumpstart the idea generation process during the capability development phase.

- Implement AI-driven use cases.

- Integrate AI opportunities using the reference architecture.

Top Trends

AI Impact on Customer-Facing Value Chains in Banks

Use the retail banking reference architecture to reveal the areas that require change, to help you determine where you should deploy it within your bank.

Begin to explore AI vendors and uses cases, to maximize the return on your AI/ML investment.

Use the AI for Small and Midsized Retail Banks report to achieve exponential outcomes and returns.

Top Trends

Generative AI Use Case Library for the Retail Banking Industry

Info-Tech’s use case library provides practical guidance to help retail banks accelerate value-driven Gen AI use case adoption.

Top Trends

AI/ML for Small and Midsize Banks

- Apply the six core benefits that AI/ML can deliver to your customer experience to help you determine where you should deploy it within your bank.

- Understand the six capabilities that AI/ML can bring to your bank's internal operations to maximize the return on your AI/ML investment.

- Mature your AI/ML approach to combine both customer-facing and internal benefits to achieve exponential outcomes and returns.

- Use our AI/ML scorecard tool to evaluate the suitability of your use cases.

Top Trends

The Future of Retail Banking

Significant changes are required throughout IT in order to enable it to:

- Partner closely with the business. Successful new development will require IT to beclose and deeply aligned with with the business.Exceptional governance and project management skills will be essential to success when entering new markets.

- Create open and agile Infrastructure. New market developments require existing infrastructure to be agile and responsive to changing conditions. Invest in API management tools and pursue a service-oriented architecture to futureproof existing infrastructure.

- Security must be a top priority. Info-Tech security diagnostics can help IT service providers to evaluate current state of your client’s security management and governance areas, including security policies and processes.

Top Trends

Mainframe Modernization for Retail Banking

Mainframe systems are more relevant than ever in modern retail banking. They are ideally suited for modern banking, and recent innovations in mainframe hardware and software are helping to combine the inherent advantages of mainframes with modern architecture, development environments, software tools, and development methodologies. A modernized mainframe system featuring microservices and APIs can become a source of competitive advantage. Strategic investments can particularly transform your mainframe into a source of competitive advantage over smaller competitors.

Top Trends

API Management in Retail Banking

- The adoption of a mature API management capability will provide a flexible and integration-friendly infrastructure state that enables:

- A structured way to achieve digital transformation.

- Easier integration of external vendors.

- A strategy to achieve a service-oriented architecture.

Top Trends

Retail Banking Legacy Systems/Transformation Report

- The Retail Banking industry is rapidly evolving. It is being influenced and reshaped by many factors. Customer bases are aging; younger, technology-savvy customers are becoming more important; and new competition is occurring.

- These forces are causing legacy technology to increasingly become a hindrance to successfully competing.

- Learn about the legacy systems/transformation trend, including challenges and opportunities, with expert assistance.

Top Trends

Retail Banking Increasingly Competitive Markets Report

- Customer expectations for financial services are increasingly redefined by non-financial/non-regulated competitors (e.g. Apple, Amazon, Uber).

- As the level of competitiveness continues to escalate, so does the pressure on financial services organizations to transform their business.

- Learn about how increasingly the competitive markets trend affects both your organization and IT specifically, including challenges and opportunities, with expert assistance.

Top Trends

Retail Banking Surveillance for Illegal Activity Report

- Banks are struggling to remain compliant with the rapidly evolving regulations, consuming significant resources as criminals are becoming ever more sophisticated.

- The risk is real, as compliance failures present huge reputational risks at a time when Retail Banking CIOs are often not seen as innovators by banking staff.

- Learn about how surveillance for illegal activity affects both your organization and IT specifically, including challenges and opportunities, with expert assistance.

3

Industry Benchmarking

Peer Benchmarking

Retail Banking IT Stakeholder Satisfaction Benchmarking Report

- IT leadership needs to understand where their clients are unsatisfied with the quality of service they are receiving from IT.

- While Financial Services as a whole is meeting stakeholder expectations, there is room for improvement when it comes to client-facing technologies and analytical capabilities, both key to competing in this rapidly transforming industry.

- Understand important focus areas to address and insights into how your team compares with other Retail Banking IT organizations.

Peer Benchmarking

Retail Banking IT Management & Governance Benchmarking Report

- Understanding your IT team’s perception of what’s important and how well they’re doing is central to identifying strengths, weaknesses, and potential misalignments with business priorities and expectations.

- Learn about how IT departments in your industry assess the importance and effectiveness of 45 IT processes to gauge your own alignment and identify select processes for targeted improvement.

Peer Benchmarking

Retail Banking IT Staffing Benchmarking Report

- Many IT departments are already running lean, struggling to keep pace with never-ending demands from the business. IT staffing is stretched thin.

- By taking the IT Staffing Assessment diagnostic and participating in our unique IT Spend benchmarking, you will gain critical information to position your team to be seen as strategic.

Peer Benchmarking

Benchmarking Report: A Cross-Industry Comparison of IT Stakeholder Satisfaction

- Every industry has unique characteristics that can hamper progress or facilitate success in satisfying IT stakeholders. Reimagine your strategy by shifting the definition of who your peers really are.

- Discover which industries achieve high stakeholder satisfaction across 13 core IT services.

- Learn the characteristics that different industries have that can help or hinder IT success.

- Understand what your industry has in common with others that you can leverage to improve stakeholder satisfaction and overcome your own institutional barriers.

4

Core Industry Technologies & Software Selection

Core Industry Technologies

Explore Next-Generation Core Banking Vendors to Unlock New Capabilities and Outpace Competition

- Aggregate the vendors into one landscape including a cross section of vendors to assure you are evaluating from a broad-based group of offerings.

- Define your bank’s key capabilities through cost and competitive advantages and map back the vendors’ capabilities to the retail banking reference architecture.

- Review the vendor functional criteria Info-Tech analyzed for ten key players in the core banking system market and summarized them.

Core Industry Technologies

Protecting PII When Using AI in Banks

You must implement several changes to your bank to secure PII and educate about AI:

- Employee training on AI and its use is essential within the bank and perhaps to influence overall culture.

- You must scan your existing systems and data to locate PII then encrypt or tokenize it. New tools have been created to scan your local, on-premises, and cloud storage to identify existing PII that needs to be retroactively encrypted or tokenized

- All new PII collected by your bank must immediately be encrypted or tokenized. Real-time encryption or tokenization will secure your future.

Core Industry Technologies

Retail Banking Core Banking Systems Report

- Core banking systems are ERP systems for banks. A wide range of products are available, with varying levels of digital maturity and modern code bases.

- Selecting the correct system is essential, and selection must consider the future plans of the organization.

- Learn about what a core banking system is, the state of the market, key features and functions, and leading vendors in the space to understand how it can transform your IT strategy and ability to deliver.

Core Industry Technologies

Retail Banking Robotic Process Automation Report

- Robotic process automation can be broadly applied to any process that involves a high level of human involvement, a low level of human judgement, and a high degree of repetitive tasks.

- Learn about what robotic process automation is, the state of the market, key features and functions, and leading vendors in the space to understand how it can transform your IT strategy and ability to deliver.

Core Industry Technologies

Retail Banking API Integration Report

- APIs ensure seamless communication between various applications and services that operate within a bank, laying the groundwork for successful legacy renewal.

- Learn about what API technology is, the state of the market, key features and functions, and leading vendors in the space to understand how it can transform your IT strategy and ability to deliver.

Latest Retail Banking Notes

Short, tailored research notes aimed at providing you with timely insights, relevant to your industry. Hot off the press, these notes will be published regularly and pair great with your morning coffee.

Meet the Financial Services and Insurance Executive Services Leadership Team

November 7, 2023

The Financial Services and Insurance (FSI) industries are ever-evolving and undergoing dramatic changes due to market conditions, increased consumer and employee demands, and a rapid need for modernization to remain competitive with both incumbents and digital-first emerging players. Our global FSI team at Info-Tech is the world-renowned provider of choice for premier CIO and executive leadership, research, coaching, and mentoring services dedicated to IT leaders. Our mission is to serve as a trusted strategic advisor to enable FSI IT leaders and increase the value of their organization. Our advice improves the teaching, learning, research, student experience, and community engagement aspects of their organizations through IT best practices and research. We will ensure that our members in the global FSI sector receive exceptional value from their investment in their Info-Tech membership as they build an exponential IT mindset to embrace the changes in the FSI industry.

The Silicon Valley Bank Failure and What to Prepare for Next

March 16, 2023

The impacts on banking, financial institutions, their customers, and technology.