The right software, right now.

Software is the engine that powers modern organizations, driving efficiency, innovation, and growth. Choosing the right software demands a forward-thinking approach that evolves with the times. And in the last few years, indeed, times have changed. If your software selection practices are stuck in 2019, chances are your applications are not delivering their promised value.

In this report, we explore 10 key practices from across the software selection lifecycle. Supported by the latest data and combined with practical next steps, this research helps IT leaders select the right software partners to maximize the value of their application portfolios.

10 software selection insights for IT leaders in 2025

Using the latest data and research, this report examines 10 leading insights across the software selection lifecycle and offers actionable next steps for redesigning practices to meet the challenges of 2025.

1. Prioritize convenience and conscience in your software choices.

In the post-pandemic era, buyer behaviors and preferences have shifted in two critical ways: remote work is driving even greater demand for cloud-first solutions and expanding ESG policies are shaping the need for ethical vendor partnerships.

2. Choose long-term substance over short-term sparkle.

When the excitement over bright and shiny product features subsides, vendors who can adapt to your changing organizational, operational, and functional requirements over the long term will be the keepers.

3. One size does not fit all. Match the solution to your needs.

Smaller, specialized vendors typically offer better point solutions, while larger vendors provide more comprehensive enterprise platforms. Your size, scope, and needs should be the guiding stars in deciding which one to choose.

4. Set it and forget it? Not anymore.

Waiting until contract renewal time to assess software performance is too late. Organizational needs and goals today are in a constant state of flux – regularly evaluating application needs will help maximize your software’s value.

5. Don’t invite everyone to the room where it happens.

To facilitate progress, software selection committees should be lean. However, it will still be critical to engage users and leaders at multiple levels to ensure that software meets both strategic and operational requirements.

6. Success will hinge on business and IT collaboration.

Now more than ever, effective collaboration between business and IT is critical for successful software selection and implementation. Working together to understand each party’s respective requirements and challenges will ensure software aligns with everyone’s needs.

7. Don’t let switching costs stand in the way of value.

Too often, organizations will opt to simply renew a vendor contract rather than deal with the perceived high costs and risks associated with switching vendors. However, the decision to stay must be based on software value – not renewal cycle inertia.

8. A formal process is de rigueur in today’s landscape.

Regardless of organization or project size, this is not the time to wing it. A well-defined selection and procurement process will avoid wasted time and effort, eliminate miscommunication and inefficiencies, and ensure that all departments are aware of the criteria for selection.

9. Due diligence applies to software integrators too.

Similar to choosing a software vendor, the implementation partner decision requires scrutiny and strategy. A third-party integrator plays an equal or greater role in the success of the software, so a poor decision here could spoil the entire product experience.

10. Make a case for simple and seamless.

It should come as no surprise that ease of software implementation and use drives higher user satisfaction and accelerates time to value. The flip side of that coin: software that is difficult to install, configure, or integrate can lead to frustration, delays, and higher costs.

Insights Into Software Selection 2025

Times have changed. Have you kept up?

When was the last time you looked at how you select and purchase software?

Selecting software is a painful experience

Few organizations have evolved how they select applications.

Selection takes forever.

Traditional software selection drags on for years: sometimes in perpetuity.

Stakeholders aren't satisfied.

Stakeholders grumble that deployed solutions don't meet critical needs.

RFP overload kills momentum.

Time is wasted documenting an endless list of table-stakes features.

Decisions aren't data driven.

Gut feel and intuition guide selection, leading to poor outcomes.

Vendors put on dog and pony shows.

Glossy presentations and slick salespeople obscure real product capabilities.

Negotiations are a weak link.

Money is left on the table by inexperienced negotiators.

The result?

Wasted time. Wasted effort.

Applications that continually disappoint.

Stop buying software like it's 2019…

Understanding the software selection process

Awareness

Define the selection process and conduct a business impact assessment.

Education & Discovery

Understand marketplace trends and validate the business case.

Evaluation

Use data to drive comparison of vendor capabilities and establish key success metrics.

Selection

Validate key issues with technical assessments and reference checks.

Negotiation & Configuration

Initiate price negotiation with top vendors and finalize budget approval and project implementation.

Insights into the software selection process

Awareness

Buyer behaviors and preferences have shifted post-pandemic in two critical ways:

- Increased adoption of cloud vs. on-premises solutions.

- Increased consideration given to environmental, social, and governance (ESG) issues.

Education & Discovery

Look beyond features to find vendors that see you as more than a sale.

Smaller and specialized vendors provide better point solutions and services.

Larger vendors provide better platform and enterprise solutions.

Evaluation

Evaluate your application needs continually – not just when the contract is up for renewal – to ensure you're getting the greatest value from your software.

Your decision-making committee should be small and contain diverse organizational perspectives.

But you should engage users and leaders at multiple levels to ensure you have the best picture of the business needs and requirements.

Good requirements and effective business-IT collaboration lead to successful software selection and implementation.

Selection

Customers will only continue to use software when the value of staying is greater than the cost of change.

Have a clearly defined and appropriately aligned selection and procurement process to avoid unnecessary wasted time and effort.

Negotiation & Configuration

Choose your third-party integrators strategically. They become part of the value in software, and a bad implementation experience will spoil the product experience.

Software that is easier to implement drives higher satisfaction.

SoftwareReviews' data accelerates and improves the software selection process

SoftwareReviews collects and analyzes detailed reviews on enterprise software from real users to give you an unprecedented view into the product and vendor before you buy.

Unless otherwise indicated, all data is provided by SoftwareReviews, collected between January 1, 2022, and September 30, 2024.

With SoftwareReviews, you can:

- Access premium reports to understand the marketspace in 193 software categories.

- Compare vendors with SoftwareReviews' Data Quadrant Reports.

- Discover which vendors have better customer relationship management with SoftwareReviews' Emotional Footprint Reports.

- Explore the Product Scorecards of individual vendors for a detailed analysis of their software offerings.

SoftwareReviews

Data Quadrant Report

- Captures data from all vendors.

- Measures 11 common vendor capabilities.

- Compares unique product features for the category.

- Provides comparative rankings for all data points.

- Awards Gold Medalists in the Data Quadrant.

- Captures data from all vendors.

- Focuses on 25 Emotional Footprint data points across five categories.

- Awards Champions in the Emotional Footprint.

- Provides a deep dive on individual vendors.

- Captures over 100 data points on each vendor.

- Includes feature, customer engagement, discounting, and segmentation information.

- Reports available for all vendors in the Data Quadrant.

1 Awareness

Buyer behaviors and preferences have shifted post-pandemic in two critical ways:

- Increased adoption of cloud vs. on-premises solutions.

- Increased consideration given to ESG issues.

Post-pandemic, the software selection landscape has shifted. The move toward cloud-based solutions became a necessity as work-from-home became the norm. Additionally, more businesses are factoring in ESG policies when selecting vendors. Organizations now prefer vendors that not only provide great software but also demonstrate ethical business practices that align with their values. This shift reflects the growing importance of holistic vendor evaluation – where company ethics are as important as the product.

Cloud solutions are no longer a nice-to-have

Cloud adoption continues to grow rapidly, with organizations opting for cloud, multicloud, and hybrid environments as part of their digital transformation strategies. This was initially driven by the need for scalability, cost efficiency, and operational flexibility, but it became a strategic imperative for organizational survival starting with the COVID-19 pandemic of 2020.

Eighty-nine percent of organizations leverage a multicloud strategy, with 73% of those taking a hybrid cloud approach (Flexera, 2024).

This shift is particularly evident in sectors like healthcare, finance, and manufacturing, where security, compliance, and return on investment (ROI) are crucial.

89% of organizations leverage a multicloud strategy.

Source: Flexera, 2024

ESG is playing a growing role in software selection

85% of organizations fail to achieve their strategic sustainability goals due to difficulty sourcing sustainable suppliers (Amazon Business, 2024).

2022 $630M -> 2032 $2.6B

Estimated growth of the ESG software reporting market (in USD) from 2022 to 2032 (Deloitte, 2023).

59% of Fortune 1000 executives use or plan to use cloud to enhance their ESG strategy (PwC, 2021).

Your next steps

Assess your organization's readiness for cloud migration to define your cloud strategy before it defines you. The blueprint Define Your Cloud Vision can show you the way.

Your vendors' commitment to ESG principles can have long-term benefits for your brand and operational alignment. Consider what matters to you about your vendors beyond just features and price. You can strengthen your corporate performance with Establish a Sustainable ESG Reporting Program.

See SoftwareReviews' ESG Reporting Software category to learn about tools that can help organizations evaluate their environmental impact.

Buyer behaviors and preferences have shifted post-pandemic in two critical ways:

- Increased adoption of cloud vs. on-premises solutions.

- Increased consideration given to ESG considerations.

2 Education & Discovery

Look beyond features to find vendors that see you as more than a sale.

In software selection, it's critical to focus beyond the initial excitement over a product's features. Often, satisfaction diminishes over time as organizations outgrow the functionality they originally sought or as shiny object syndrome subsides.

Business, operational, technology, and functional requirements will change over time, and the vendor must meet these changing requirements to retain customers. Selecting a vendor based on their Emotional Footprint – including traits like trustworthiness, transparency, reliability, long-term vision, and ability to innovate – will ensure that your business remains supported through changes.

Good customer experience goes beyond what you receive from the product. The service and product go hand-in-hand since they represent the same brand. Choosing a vendor who acts as a long-term partner and is capable of adapting to your evolving business needs will help mitigate dissatisfaction in the long run.

Negotiation is a critical first step in the relationship

A bad negotiation experience is a warning sign. If the vendor doesn't put their best foot forward in negotiation, why would they put their best foot forward once they've locked you into a contract?

SoftwareReviews data shows that those who had a good negotiation and contract experience were more likely to recommend the software: 94% of users who had a positive negotiation experience were highly likely to recommend the product, compared to only 48% of those who had a negative experience.

Learning to negotiate is crucial. Taking the time to understand how and when to leverage your position can result in huge cost savings and decreased risk.

Likeliness to Recommend Software Based on Negotiation & Contract Experience

Positive vs. negative negotiation experience is based on the Net Emotional Footprint (NEF) for overall negotiation and contract experience. The NEF is calculated by subtracting the negative emotions (-4, -3,-2, and -1) from the positive emotions (2, 3, and 4). Net Promoter Score (NPS) is based on likeliness to recommend the product and is calculated by subtracting the detractors (1-6) from the promoters (8-10).

Source: SoftwareReviews user review data, 2022-2024; N=68,467

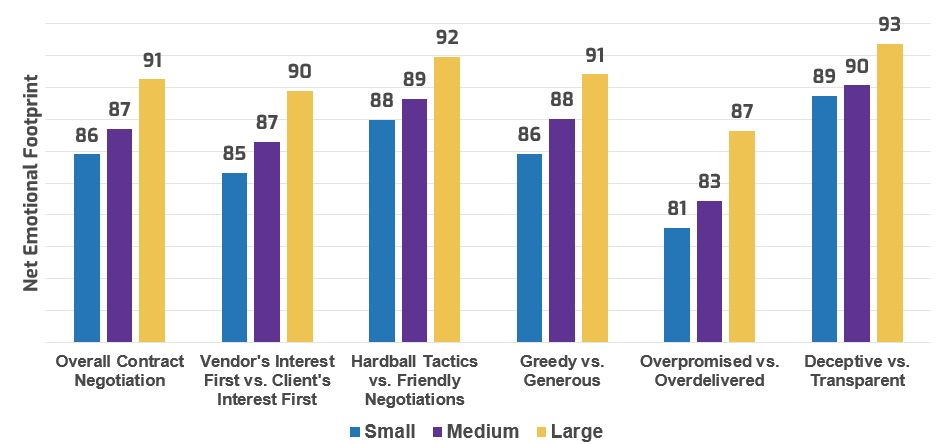

Negotiations rarely go as smoothly for smaller organizations as they do for larger ones

Software users rated their feelings about the vendor during the negotiation and contract experience. Specifically, they rated their feelings on a negative to positive scale for:

- Vendor's Interest First vs. Client's Interest First

- Deceptive vs. Transparent

- Hardball Tactics vs. Friendly Negotiations

- Greedy vs. Generous

- Overpromised vs. Overdelivered

For each rating, users from smaller organizations had fewer positive feelings toward the vendor's negotiation and contract tactics compared to those from medium and large organizations.

The Net Emotional Footprint score subtracts the percentage of negative sentiments from the percentage of positive sentiments. A higher Emotional Footprint means there was a higher percentage of positive than negative sentiments toward the vendor (SoftwareReviews user review data, 2022-2024; N=68,436).

The difference between surface-level and deep satisfaction is time and impact

Surface-level satisfaction

Surface-level satisfaction has immediate effects but is usually short-term or limited to certain groups of users. There are several factors that contribute to satisfaction, including:

- Novelty of new software

- Ease of implementation

- Financial savings

- Breadth of features

Deep satisfaction

Deep satisfaction has long-term and meaningful impacts on the way that organizations work. It has staying power and increases or stays the same over time by reducing complexity and delivering exceptional quality for end users and IT alike. This report found that that the following capabilities provided the deepest levels of satisfaction:

- Usability and intuitiveness

- Quality of features

- Ease of customization

- Vendor-specific capabilities

What contributes to deep satisfaction?

| 43% Delights | Usability and intuitiveness |

| Software needs to be consistently intuitive to satisfy the user. A good user experience is now a necessity for consumer apps and business apps alike. | |

| 44% Delights | Quality of features |

| Quality over quantity delights users because it not only assures the success of workflows but also provides a satisfying user experience. | |

| 40% Delights | Ease of customization |

| Ease of customization may prove difficult for IT administrators, but the more that users can customize their apps, the more satisfaction they'll feel. | |

| Vendor Dependent | Vendor-specific capabilities |

| While the above capabilities delight users in general, it is crucial to make decisions regarding specific vendors using vendor-specific satisfaction. |

Focus on the emotional footprints that provide long-term satisfaction

Satisfaction also depends on organizations' emotional relationships with vendors. Looking at the factors that contribute to long-term satisfaction in long-term contracts (11 years or more), these factors came out on top:

- Respectful

- Reliable

- Trustworthy

- Integrity

- Performance Enhancing

Info-Tech Insight

Emotional Footprints matter when it comes to sustaining satisfaction. Knowing how users feel about their service experience is important. It is also important to note that satisfaction wanes over time.

Your next steps

Look beyond features to find vendors that see you as more than a sale.

Evaluate potential vendors for their long-term viability, not just their product features. Ensure they have a track record of supporting clients through different growth stages and business changes. Explore SoftwareReviews to gather insights into the performance and emotional footprint of thousands of technology products using comprehensive reviews from trusted practitioners and verified end users.

Bring at least two vendors you're seriously evaluating to the negotiating table. If one is giving you a particularly difficult time during negotiations, go with the vendor who's more transparent, friendly, and putting your interests first – data shows you'll have a more positive experience overall with the software.

Negotiate your next contract with the confidence that Info-Tech experts in Vendor Contract & Cost Optimization are getting you a great deal.

Applications Priorities 2025

Applications Priorities 2025

Rationalize Your Application Portfolio

Rationalize Your Application Portfolio

Extend Agile Practices Beyond IT

Extend Agile Practices Beyond IT

Integrate Portfolios to Create Exceptional Customer Value

Integrate Portfolios to Create Exceptional Customer Value

Automate Your Software Delivery Lifecycle

Automate Your Software Delivery Lifecycle

Build Your BizDevOps Playbook

Build Your BizDevOps Playbook

Modernize Your Applications

Modernize Your Applications

Embrace Business-Managed Applications

Embrace Business-Managed Applications

Build an Application Department Strategy

Build an Application Department Strategy

Review Your Application Strategy

Review Your Application Strategy

Assess the Value Drivers Within Your Solutions

Assess the Value Drivers Within Your Solutions

2020 Applications Priorities Report

2020 Applications Priorities Report

Applications Priorities 2022

Applications Priorities 2022

Make the Case for Product Delivery

Make the Case for Product Delivery

Satisfy Digital End Users With Low- and No-Code

Satisfy Digital End Users With Low- and No-Code

Select a Sourcing Partner for Your Development Team

Select a Sourcing Partner for Your Development Team

Applications Priorities 2023

Applications Priorities 2023

Make the Case for Enterprise Business Analysis

Make the Case for Enterprise Business Analysis

Decide if You Are Ready for SAFe

Decide if You Are Ready for SAFe

Adopt Generative AI in Solution Delivery

Adopt Generative AI in Solution Delivery

Applications Priorities 2024

Applications Priorities 2024

Build Your Exponential IT Product Practice

Build Your Exponential IT Product Practice

Insights Into Software Selection 2025

Insights Into Software Selection 2025

Stay Relevant in the Era of AI-Powered Search

Stay Relevant in the Era of AI-Powered Search

Transform IT, Transform Everything

Transform IT, Transform Everything

Building Info-Tech’s Chatbot

Building Info-Tech’s Chatbot

Assessing the AI Ecosystem

Assessing the AI Ecosystem

Building the Road to Governing Digital Intelligence

Building the Road to Governing Digital Intelligence

Bring AI Out of the Shadows

Bring AI Out of the Shadows

The AI Vendor Landscape in IT

The AI Vendor Landscape in IT

An Operational Framework for Rolling Out AI

An Operational Framework for Rolling Out AI

Applications Priorities 2026

Applications Priorities 2026