- Analyst relations (AR) programs often struggle when approached as a PR initiative.

- Failure to understand industry analyst value and how to apply analyst insights within the business to drive return on investment (ROI) makes it difficult to achieve the benefits of AR.

- Identifying when and how to apply executive and product time and effort within the research and company decision-making process is a challenge.

- Many programs lack a funding strategy to staff appropriately and keep up with demands simply because of a PR-style approach. Low results mean low funding.

Our Advice

Critical Insight

- Applying insights from analyst engagement to key product and product marketing decisions will enable AR programs to deliver ROI in early stages of maturity.

- “Pay to play” is a myth when describing top firms, but you must be vigilant to apply analyst insights properly to derive ROI from your research investments.

- Hone your skills and validate value among executives and product teams in your early stages of AR maturity. Advanced stages will see your program helping with strategic decisions.

Impact and Result

- Build more effective participation in the research process.

- Firmly establish AR as a partner to the business, helping executives start to see the benefits of your program.

- Improve industry analyst awareness of your brand, company, and products, leading to increased analyst mentions increase.

Build a Strong Analyst Relations Foundation

Effective AR leaders align to corporate priorities and work with operational leaders to apply analyst insights to build better products.

Analyst Perspective

Build a Strong Analyst Relations Foundation

In my 25+ years coaching analyst relations professionals, I've seen varying definitions of AR program success. We've found that about 25% of AR programs deliver actual business value back to their companies, while a majority (around 65%) of the rest are using tactics and metrics that fail to deliver return on investment, leaving the program susceptible to reductions and cost-cutting.

What does work is building a strategic AR program that moves beyond the PR-focused approach of outbound-only communications to where AR orchestrates analyst inputs into product and company improvements, delivers ROI back to the business, and wins product team and CEO-level support. Getting started in AR successfully requires three simple steps:

- Identify the key analysts that have the most knowledge of buyer wants and needs in your tech segment and apply best practices in briefings, inquiry, and aligning to the research process to achieve a recognizable win in your first 90 days.

- Set your sights on moving through the "outbound-only" PR-focused phase of AR to engage analysts to help your product teams and other functional leaders build a better business.

- And finally, recognize that analysts need proof to back up claims of leadership, so cultivate customer references and reviews as evidence of "being the best."

While the strategy and tactics take years to hone, our blueprint pays immediate dividends by helping you achieve success in your first 90 days and gets you on the right path toward a successful and high-impact analyst relations program.

Jeff Golterman

Managing Director

Info-Tech/SoftwareReviews

Marketing Research and Advisory

Executive Summary

AR Program Startup Challenges

Challenges plague early- to mid-stage tech providers who are looking to get started in AR to build a successful program that is effective and long lasting:

- Finding the right analysts and firms from over 5,000 industry analysts and understanding what makes them tick and how they do their jobs.

- Understanding the intricacies of the research process and how and when to dedicate vast amounts of time and effort to participate.

- Building the right team of executives to support briefings and ongoing analyst engagement that will deliver the highest ROI back to the business.

- Growing AR staff – many startup programs lack a funding strategy to staff appropriately and keep up with demands simply because of a PR-style approach. Low results mean low funding.

Common Obstacles

AR professionals describe the friction they experience while building their programs:

- Analysts may not pay attention to you or your company, frustrating your executives.

- AR professionals new to the role often lack a roadmap on how to build a successful program.

- Product teams, whose engagement is imperative in AR program success, sometimes push back on briefing analysts before the product is ready.

- Sometimes AR is given PR-like marching orders to brief as many analysts as possible, leading to AR failing to deliver real value back to the business.

- Analysts need references and reviews to evaluate your company; often, these don't exist when you start building your program.

SoftwareReviews' Approach

This SoftwareReviews blueprint provides the guidance and tools required to enable AR leaders to:

- Understand a solid vision for what great AR looks like when starting a program.

- Understand how to target industry analysts and create an effective plan for how best to engage.

- Learn about best practices for aligning to the analyst research process and preparing for and delivering successful briefings and analyst inquiries.

- See clearly how to engage analysts during the critical product design, development, and launch process and why that is crucial in delivering ROI back to the business.

Finally, we support you with tools and presentation templates that save time and effort as you build, grow, and optimize a world-class AR program.

SoftwareReviews Insight

Well-timed key analyst engagements can deliver insights that, when applied to key product and product marketing decisions, will enable AR programs to deliver more ROI than PR-focused outbound-only programs.

Build a strong analyst relations foundation

This research is for:

Analyst relations leaders and team members looking to:

- Ramp up quickly and achieve success when new in an AR role.

- Understand what analysts want in an AR relationship.

- Strengthen analyst relationships.

- Refine analyst coverage strategies.

- Optimize analyst engagement around product design, build, and launch cadence.

- Win executive support for your AR program.

This research will also assist:

- Early and mid-stage tech company CEOs building or rebuilding an analyst relations program.

- CMOs, marketing leaders, heads of public relations, and even product managers and marketers whose support for AR is imperative for program success.

"AR is key to scaling a business. It's never too early to start thinking and planning an AR strategy. Even for early-stage companies (sub $5 million in revenue), AR can provide powerful benefits."

– Nick Barber, Vice President, Growth Platforms, Insight Partners

Build trust among AR, analysts, and executives

This blueprint is focused on the first three steps in AR maturity. Strategic and Innovative AR will be covered in an additional blueprint.

Our approach here is helping AR professionals move from a no/low maturity state toward a state where trust among analysts, your executives, and you as AR lead establishes a solid foundation.

Analyst Relations Program Maturity

ROI

HIGH: Greater ROI as you apply analyst insights to achieve revenue faster and improve win rates.

LOW: ROI of PR-focused program is hard to measure as you can't directly measure any analyst mentions.

Obstacles are expressed many ways

AR professionals reveal many symptoms of AR programs that could use a tune-up:

- "We're an early- or mid-stage startup and want to build a successful AR program from the ground up."

- "We lack awareness among industry analysts."

- "It's a pay-to-play game, and larger vendors with bigger research contracts get better rankings."

- "The analysts just don't get it and aren't listening to what we tell them."

- "We don't meet the revenue thresholds for coverage, so we will work with firms that have lower standards and will write good stuff about us."

- "We tried working with the industry analysts, and because it went nowhere, our CEO has pulled the plug on additional investments."

- "There are 5,000 industry analysts out there and we can't cover them all, and expanding our headcount in AR is hard to justify."

Root cause analysis reveals:

25% |

We estimate only 25% of AR programs deliver measurable business value, causing a lack of funding needed for effectiveness… |

|---|---|

65% |

…because the majority of AR leaders say they use traditional PR-oriented metrics. This leaves AR not strategic and open to cost cutting. |

What AR metrics do we strive for when getting started?

Strategic Analyst Relations: Applies analyst advice and insights through frequent and early engagement to enable mission-critical priorities and builds programs to deliver the evidence analysts need to improve provider ratings.

Leading AR professionals use business metrics and strive to answer "yes" to the following in the early stages of the AR program:

- # of early-stage analyst interactions – Did we engage analysts early and frequently enough to enable more competitively differentiated products?

- # of faster launches enabled – Did we save the business time in understanding market and customer needs so the product launched faster and gained revenue more quickly than if we did not use analysts?

- # of deals won, higher deal win rates – If we had a sales-facing AR program, did we positively impact sales?

Use business metrics alongside the traditional metrics

- Positive rating changes over time

- (Positive) Tonality

- Volume of published research on your company

- Ability to cultivate adequate customer references

- Leadership positions in published research

- Number of analysts covered

Vital attributes of strategic AR

Successful AR depends on many program attributes, but three stand out as most important:

Align to CEO Priorities |

Seek Analyst Input Early |

Share Proof With Analysts |

|---|---|---|

Engage with analysts to drive the CEO's mission-critical priorities, especially around product/portfolio goals, linking AR program success to delivering business benefits. |

Engage analysts early in decision-making and product development processes, giving product teams, marketers, and executives time to apply to drive improvements. |

Ensure proof points for product and company capabilities – customer references, buyer reviews, product performance demos, and data – are communicated effectively to analysts. |

"Analyst Relations is a strategic activity that has to be championed inside the company to be taken seriously by anyone outside."

– Louis Colombus (iUniverse, 2004)

Which analysts are you targeting?

With analyst churn, identifying which of the 5,000 industry analysts and influencers to target is a challenge.

Tier 1: |

Tier 2: |

Tier 3: |

|---|---|---|

Your lead analyst |

The market(s) in which you want to compete |

The markets in which you currently compete |

|

|

|

Most AR professionals feel they can only build trust-based relationships with eight to ten analysts. Targeting is crucial!

Source: 20+ years of author surveys and inquiries with AR teams

"Productize" your approach to supporting the research process

AR is not about influencing analysts but about learning the research process and analyst and buyer evaluation criteria.

For early- to mid-stage providers just getting started and "at-scale" providers who want reminders of best practices:

- Develop a master calendar of Gartner Magic Quadrants (MQ), Forrester Waves, and Buyer Review publishing cycles to understand start and publish dates. Understand that deliverable dates will be for each major process milestone. Stay in front of the process.

- Do your homework. Understand the market definitions and current evaluation criteria. Understand the inclusion criteria for the required revenues, installed base, and geographical footprint. This helps you understand analyst changes to evaluation criteria more easily.

- Pay attention to documentation and research, especially welcome-packet materials where clues to what analysts are looking for are in the definition (which is based on current and emerging end-user needs) and evaluation criteria (what is required of the vendors to fulfill the market definition). Read the guidance that analysts give buyers in the research.

- Identify your team you depend on for needed information – your executives, product teams, marketing, sales teams, etc. – and calendar their involvement in analyst briefings and inquiries. Work closely with the teams that manage buyer reviews and customer advocacy.

Provider Evaluation Methodologies

Currently covered? Optimizing the research process still requires practice

Once you are covered by an analyst's methodology, remember that goalposts move as your competitors invest and leadership criteria change. Standing still means you are falling behind!

For mid-stage to at-scale providers already covered within analyst research:

- Overall – Leverage every activity as part of the MQ, Wave, or another research process. "We are always in MQ, Wave, Data Quadrant/Emotional Footprint season" is the right AR leader mindset.

- Embrace analyst and buyer cautions on your company/products – These are your golden nuggets to drive product and business capability improvements. Analysts will look for evidence (customer references) that you have addressed those cautions. Buyer reviews give many more data points and details beyond analyst opinion. Use both for a complete picture.

- Develop analyst engagement plans* – Plan analyst engagement according to the schedule and critical milestones. Leverage resources such as SoftwareReviews engagement managers.

- "Always Be Cultivating" references and buyer reviews – Work with the analysts to understand the best customer reference characteristics. Be prepared to deliver references that address the analyst and buyer cautions on your company or offerings.

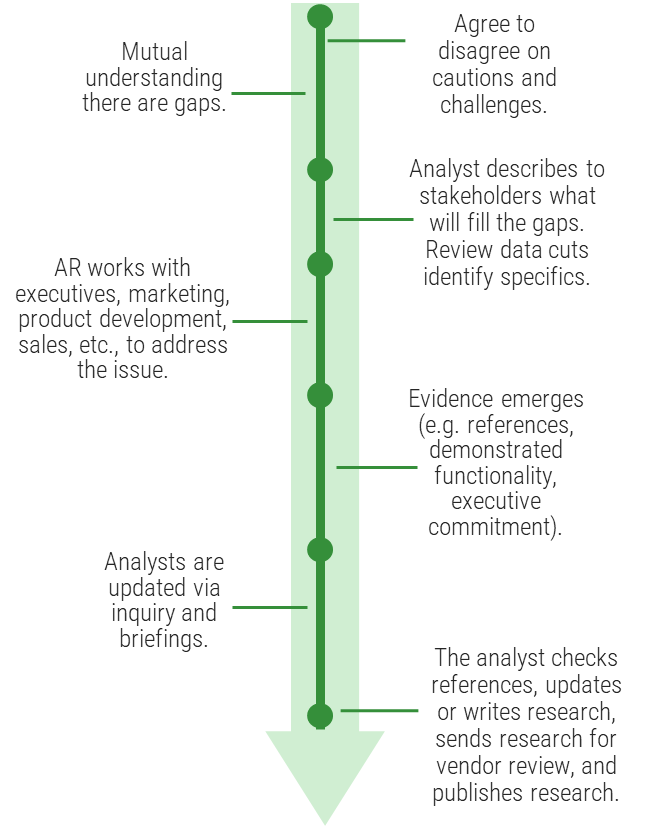

Research Position Update Process

The current state of features and capabilities

A new state of features and capabilities

Use analyst briefings wisely and be prepared to answer, "Why are we here today?"

Leading AR professionals tailor analyst briefings to how the analyst evaluates vendors.

Be concise.

Focus; less is more.

Maximum 20 slides per hour.

Build in time for questions.

- The objective of a general analyst briefing is to provide answers to these questions for analysts:

- What client needs do you best fit?

- Where is your "sweet spot"?

- Who are you targeting?

- Who are you not targeting?

- What makes you different?

- Briefings contribute to an analyst's overall impression of your organization — simple steps can help you achieve the desired impact.

- Hold analyst-specific briefing sessions for key announcements, especially with your lead Tier 1 analysts.

- Be consistent and top of mind.

- Present more than annual updates on your business.

- Include briefings as part of your product release schedule.

- Focus on a key objective.

- Narrow the analyst audience.

- "Narrowcasting" speeds scheduling and improves the efficacy of the briefing.

- Fit into an analyst's agenda – address changing customer requirements, emerging market trends, competitive shifts, or cool new technologies (e.g. target the "Cool Vendors" report).

- Ask analysts how they see the market changing and how new and emerging trends will affect your markets. Use inquiry far more than briefings.

Engage analysts on a continuous basis. Start early in decision/development cycles!

AR leaders connect product and marketing teams to analysts early so feedback can be applied to improving product-market fit, messaging, and launch success.

INBOUND – Applying analyst insight and feedback, insights from customer reviews, and workshops.

The ROI from your inbound AR program is what pays for your outbound activities.

Strategic AR builds a better business and higher ROI

Example: Applying analyst insights to product launch – faster time to revenues and higher win rates

"Executing on a program that is tightly aligned to business goals and outcomes makes executives care about the AR program since in supporting it, they would be helping themselves. Through the work that analysts do – whether it is in the research that they author, the feedback they direct our way, or in the inquiries that we can facilitate – helps negotiate better stakeholder engagement."

– Susan Prakasam, Senior AR Manager, Microsoft Asia

(Analyst Relations, 2016)

Customer testimony is the currency in which analysts trade

While some analysts rely on buyer reviews data, others require customer references. You need an effective program to build and capture testimonials and references.

"Always Be Capturing" customer references:

- Analysts constantly hear tech providers claim they're a leader.

- Claims of product and company prowess must be backed by proof.

- Leading AR teams have strong customer reference programs to deliver that proof.

- Provide rewards to motivate customers and sales team to participate.

- Focus your reference capture to support claims of leadership and answer analyst cautions and concerns.

- If you hear from Sales, "My customers' solutions are so strategically valuable they don't want to share what they are doing with analysts," know that if the customer is a client of the analyst company, analysts can do an inquiry with that customer and learn about how they are using your solution under standard inquiry confidentiality agreements.

Customer Testimony Delivery Moments

During the research process

- Some analysts require you to submit names of customer references.

- Others use buyer review platforms as a source.

During analyst days and customer events

- Put key customer case study sessions on the agenda.

- Allow analysts to meet one on one with key customers.

During analyst inquiry process

- Ask customer references to launch requesting analyst's inquiry.

ROI of moving from no AR or PR-focused AR to product-focused AR is significant

The incremental investments in staff and budget to bring key analysts in to strengthen product-market fit and build competitive edge has a high ROI.

OUTCOMES |

METRICS |

BUSINESS IMPACT |

BENEFITS |

|

|---|---|---|---|---|

Build a Strong Analyst Relations Foundation |

|

|

|

|

|

|

|

|

Our approach helps you build a strong AR foundation in six steps

Build a Strong Analyst Relations Foundation |

|

|---|---|

Steps |

1.1 Prioritize firms, markets, and analysts. |

Outcomes |

|

Your first 90 days

If new to the AR role, aim to diagnose the current program, contact Tier 1 analysts for feedback, and attain a "win."

- Identify key analysts, tier them based on coverage and clout, introduce yourself, and listen to their perspectives on your company and your current program. Start to build personal relationships.

- Set vision, goals, and metrics/KPIs for strategic AR.

- Diagnose program strengths, weaknesses, opportunities, and threats (SWOT).

- Identify your internal stakeholders, executives, and teams who will care about what you're working on. Reach out and understand key initiatives.

- Capture customer references and reviews.

- Figure which of your staff are worth keeping and which might need improvement.

- Develop action plans reflecting upcoming analyst reports and the timing of major internal initiatives such as product launches or new partnerships.

- Initiate product lifecycle analyst engagement.

- Calendar the major milestones for key initiatives and work backward to develop your plan.

- After 90 days, you should be able to count at least one or two high-profile wins, such as a report that you got someone to write or a low-hanging fruit you can count as a victory.

Insight Summary

A strong foundation for AR is all about enabling commercial product success.

Well-timed key analyst engagements can deliver insights that, when applied to key product and product marketing decisions, will enable AR programs to deliver more ROI than PR-focused outbound-only programs.

Start when you are early stage and qualify for inclusion.

Fine-tune your strategy and work out the bugs when you are beneath the minimum inclusion revenues and footprint of key methodologies so that when you qualify for inclusion, you're up to speed and engaging with analysts correctly.

"Pay to play" is a falsehood with top firms.

The most reputable firms got there because of independence and objectivity. Research seat costs can be high among large firms, but you pay for analyst advice to guide your company – not to influence the analysts. Do your ROI homework.

Align analyst engagement with product lifecycles.

Time analyst interactions with your product design, build, and launch rhythms. The ROI from building better products with analyst input delivers more returns than the position in the quadrant.

Brief half as much as you apply analyst insights.

Attack this metric. If you are briefing more than listening and using analyst advice, you have a PR-focused program and low/no ROI. Move your metrics to embrace the analyst engagement metrics and contribute to revenues.

Build strong customer references and reviews.

Analysts require customer references and published reviews to factor into how they rate and rank you. Drive both because these are demos and benchmarks – the proof points to back up your leadership claims.

Set an achievable goal for your first 90 days.

Early wins such as an influential analyst briefing, a mention in an analyst report, a tribute to prospective buyers, or an invite to participate in an upcoming quadrant process get you the executive support you need.

Build these foundational elements to prepare you for advanced AR

Hone your teams' skills and capabilities in the above foundational areas. This will prepare you to expand beyond product-focused AR and support executive strategic decisions. Building a reputation for positive operational change is needed to become strategic.

AR Program Building Tools

This kit includes a comprehensive set of tools to help you target the right analysts and markets to prepare and execute your participation in the research process, briefings, and analyst engagement.

![]()

Research Firm Markets Tracker

Identify specific markets to pursue, inclusion and leadership criteria, and progress.

![]()

Analyst Engagement and KPI Tracker

Easily keep track of analyst engagements and measure attainment of KPIs.

![]()

Customer References and Reviews Tracker

Plan, target, and track progress while you build customer testimonials and buyer reviews.

AR Program Markets Pursuit Presentation Template

Easily present the status of pursued markets to executives and stakeholders.

Analyst Briefing Presentation Template

Lead your team in more effective and successful analyst briefings.

Key Deliverable

AR Program Goals and KPIs Presentation Template

Win executive support and track AR program success

Marketing Management Suite Software Selection Guide

Marketing Management Suite Software Selection Guide

Social Media

Social Media

Build IT Capabilities to Enable Digital Marketing Success

Build IT Capabilities to Enable Digital Marketing Success

Select and Implement a Social Media Management Platform

Select and Implement a Social Media Management Platform

Develop a Web Experience Management Strategy

Develop a Web Experience Management Strategy

Optimize Lead Generation With Lead Scoring

Optimize Lead Generation With Lead Scoring

Create a Buyer Persona and Journey

Create a Buyer Persona and Journey

Build a More Effective Go-to-Market Strategy

Build a More Effective Go-to-Market Strategy

Leverage Web Analytics to Reinforce Your Web Experience Management Strategy

Leverage Web Analytics to Reinforce Your Web Experience Management Strategy

2020 Applications Priorities Report

2020 Applications Priorities Report

Diagnose Brand Health to Improve Business Growth

Diagnose Brand Health to Improve Business Growth

Get Started With Customer Advocacy

Get Started With Customer Advocacy

Pick Your Price Model

Pick Your Price Model

Diagnose and Optimize Your Lead Gen Engine

Diagnose and Optimize Your Lead Gen Engine

Develop the Right Message to Engage Buyers

Develop the Right Message to Engage Buyers

Identify the Customer Satisfaction Metrics That Matter

Identify the Customer Satisfaction Metrics That Matter

Create an Effective SEO Keyword Strategy

Create an Effective SEO Keyword Strategy

Accelerate Business Growth and Valuation by Building Brand Awareness

Accelerate Business Growth and Valuation by Building Brand Awareness

Social Media Management Software Selection Guide

Social Media Management Software Selection Guide

Build a More Effective Brand Architecture

Build a More Effective Brand Architecture

Build Competitive Intelligence for Market Success

Build Competitive Intelligence for Market Success

Create Assets to Accelerate the Buyer Journey

Create Assets to Accelerate the Buyer Journey

Brand Strategy: Establish and Cultivate a Flourishing Brand

Brand Strategy: Establish and Cultivate a Flourishing Brand

Build Investor Awareness to Secure Next-Round Financing

Build Investor Awareness to Secure Next-Round Financing

Improve Win Rates With a Sales Enablement Strategy

Improve Win Rates With a Sales Enablement Strategy

Scale Your Marketing Department

Scale Your Marketing Department

Choose the Right Channel Sales Partner

Choose the Right Channel Sales Partner

Redesign Your Website to Increase Business Value

Redesign Your Website to Increase Business Value

Build Your Account-Based Marketing Strategy

Build Your Account-Based Marketing Strategy

Build a Strong Analyst Relations Foundation

Build a Strong Analyst Relations Foundation

Improve External PR Communications for Greater Product Launch Success

Improve External PR Communications for Greater Product Launch Success

Turn Share of Voice Growth Into a Strategic Weapon

Turn Share of Voice Growth Into a Strategic Weapon

Optimize the Right Metrics to Scale Your Business

Optimize the Right Metrics to Scale Your Business

Leave a Lasting Impression With a Compelling Brand Identity

Leave a Lasting Impression With a Compelling Brand Identity

Hire Your Marketing Dream Team

Hire Your Marketing Dream Team

Match Your Budget to Your Market Position

Match Your Budget to Your Market Position

Capitalizing on AI

Capitalizing on AI

Generative AI Use Cases for Marketing, Sales, and Customer Service

Generative AI Use Cases for Marketing, Sales, and Customer Service

The AI Advantage for Smarter Marketing – A Primer

The AI Advantage for Smarter Marketing – A Primer

Build, Buy, or Shut It Down

Build, Buy, or Shut It Down

Event Activation Playbook

Event Activation Playbook

Crush Your Product Launch

Crush Your Product Launch

Go-to-Market Strategy on a Page

Go-to-Market Strategy on a Page

Maximize ROI on Sales and Marketing Collateral

Maximize ROI on Sales and Marketing Collateral

From Silos to Synergy: Create Marketing and IT Alignment

From Silos to Synergy: Create Marketing and IT Alignment

Competitive Intelligence Software Selection Guide

Competitive Intelligence Software Selection Guide

The Power of Segmentation

The Power of Segmentation

Revolutionize Your Customer Onboarding

Revolutionize Your Customer Onboarding

Search Engine Optimization Software Selection Guide

Search Engine Optimization Software Selection Guide

Build Better Dashboards Across Marketing, Sales, and Customer Success

Build Better Dashboards Across Marketing, Sales, and Customer Success

Make the Case for RevOps

Make the Case for RevOps

The First 90 Days as a CMO

The First 90 Days as a CMO

Stay Relevant in the Era of AI-Powered Search

Stay Relevant in the Era of AI-Powered Search

Build Your Product-Led Growth Playbook

Build Your Product-Led Growth Playbook

Elevate Analyst Relations

Elevate Analyst Relations

Level Up Your Social Media Game

Level Up Your Social Media Game

The Omnichannel Playbook

The Omnichannel Playbook

Digital Experience Platform Selection Guide

Digital Experience Platform Selection Guide

Software Buyer Insights 2025

Software Buyer Insights 2025

Optimize Your CX Strategy

Optimize Your CX Strategy